Financial Accounting And Reporting Assignment

Part one: Introduction

Financial accounting is required to analyses and convey an entity's financial performance and status in a particular accounting period. Financial accounting has been used to accumulate or identify the financial information that has required for decision-making in an entity. The report has shed light on analysing the financial performance and position of “Boohoo Group Plc” by calculating financial ratios. “Boohoo Group Plc” has founded in 2006 by “Carol Kane and Mahmud Kamani” In Manchester’s textile district. The company has been identified for its innovative approach in the fashion industry by providing quality products and generating sales of £1 billion recently (Boohooplc.com, 2022).

Trust New Assignment Help for unparalleled academic assistance. With our assignment help online , students receive personalized support and guidance from experienced professionals. Explore our Free Sample to access a wealth of knowledge and elevate your academic performance.

Figure 1: Share price of Boohoo Group Plc

(Source: Finance.yahoo.com, 2023)

The above figure has depicted that the price of the has fallen to 103.90 at the end of 2022 due to the poor financial performance of the firm, the shares have recently declined to £54.28 in 2023 (Finance.yahoo.com, 2023).

Part two: Financial analysis

Calculation and interpretation of financial ratios

The financial performance of an entity has been evaluated by effective implication of “ratio analysis techniques”. As per the reference of Husna and Satria (2019), the change in the financial performance of an entity has been correctly evaluated by implicating “ratio analysis tools”. The financial performance and status of “Boohoo Group Plc” have been calculated and evaluated for the last two years. The four specific ratios are “profitability, liquidity, leverage, and efficiency” of the firm calculated to analyses its current performance compared to past performances.

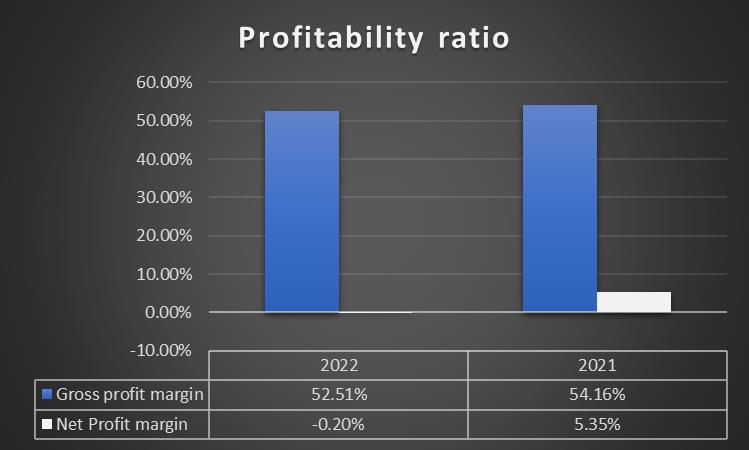

Profitability

The rate at which profit is generated by an entity based on the total revenue after adjusting “direct and indirect expenses” has been analysed by the profitability ratios of a firm (Kadimet al. 2020). The gross profit and net profit margin of “Boohoo Group Plc” for 2021 and 2022 have been calculated to measure the profitability position of the firm. The increase in profitability has depicted improved or sound financial health of a firm.

Figure 2: Profitability of Boohoo Group Plc

The gross profit and net profit margin of the enterprise were 54.16% and 5.35% in 2021. However, the rate had fallen to 52.51% and -0.20% in 2022, and the profitability of the company has declined due to reducing in net income for the firm from £93 million to -£4 million in 2022 (Boohooplc.com, 2023). The company has lacked in attracting customers as a consequence of this cost of the company has increased which has reduced the “profitability of the company” in 2022.

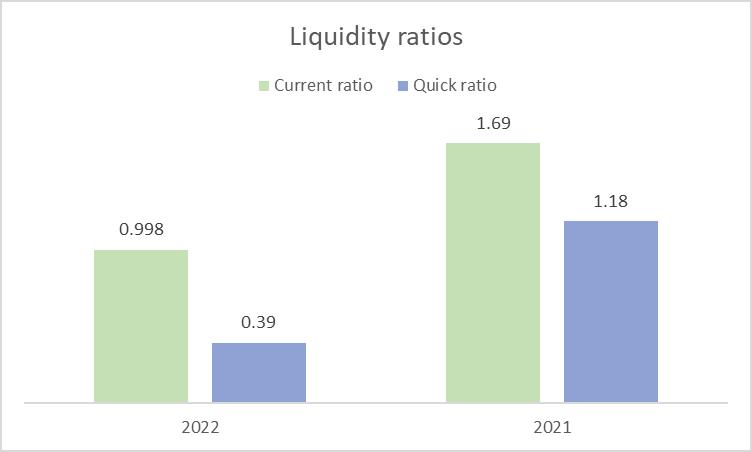

Liquidity

The “short-term position” of an entity over the different accounting periods has been evaluated by determining liquidity ratios (De Vito and Gómez, 2020). “Liquidity ratios” has depicted the existence of short-term assets in a firm to cover or paid off the short-term obligations of an entity. The “current and quick ratio” of “Boohoo Group Plc” has been calculated to analyses its “short-term financial position” in 2021 and 2022.

Figure 3: Liquidity of Boohoo Group Plc

The “current ratio” of the company has declined from 1.69:1 to 0.998:1 in 2022. This has depicted that the short-term obligations of the firm have increased in 2022 compared to 2021. The “current assets” of the firm have declined from £483 million to £460.70 million in 2022. The current liabilities of the firm have increased to £461.70 million from £286 million in 2022 (Boohooplc.com, 2023). This has been the basic reason for the decline in the current ratio of the firm. The “quick ratio” of the firm declined from 1.18:1 to 0.39:1 in 2022. This depicts that the company has lower current assets compared to liabilities in 2022. The company has higher unsold inventories in 2022 compared to 2021 which has been the basic reason for the decline in liquidity of the firm.

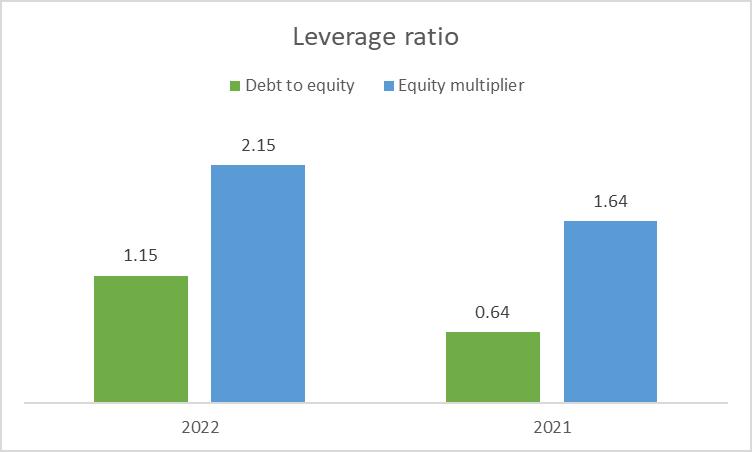

Leverage

The long-term solvency of a firm has been interpreted or evaluated by effective implication or determination of the leverage position of an entity. The “debt-to-equity and equity multiplier” of Boohoo Group Plc for 2021 and 2022 has been calculated to outline the solvency of the firm. The higher “debt to equity” has depicted the “poor leverage position” of a firm in the accounting year. The “equity multiplier” has depicted the relationship between the total assets and “shareholders' funds” in an entity.

Figure 4: Leverage ratio of “Boohoo Group Plc”

The above figure depicted that the debt to equity of the enterprise was 1.15:1 in 2022 and 0.64:1 in 2021. It has been noted that the financial burden o the company has increased due to an increase in the amount of total debt from £303 million to £534 million in 2022 (Boohooplc.com, 2023). However, due to the constant decrease in share value, the equity of the firm has lower than the debt which has raised the debt to equity of the firm. The equity multiplier of the company was 2.15:1 which depicted that the company has total assets twice that of equity.

Efficiency

The approach of an entity to utilize its assets and manage its liability to generate profit in an entity has been measured by efficiency ratios (Nižetićet al. 2019). The “inventory turnover and account receivable days” of the company have been calculated and evaluated to acknowledge the “efficiency performance” of the firm in 2021 and 2022.

Figure 5: Efficiency ratio of “Boohoo Group Plc”

The above graph has provided visualize an overview of the efficiency position of the company in the last two years. The “inventory turnover days” of the company were 66 days in 2021 and 108 days in 2022. This has depicted that the inventory turnover days of the firm have increased which has reflected the poor efficiency of the company to sell off its inventories in the market. The “poor supply chain” has been the basic reason for the left unsold inventories of £279 million in 2022 which has reduced the efficiency of the firm. The “account receivable days” of the company have increased to 10 days from 8 days in 2022. This has depicted that the company has taken more time to collect dues from customers in 2022 compared to 2021. The increase is in “accounts receivable” to £58 million from 41 million in 2022.

Factors that have affected the performance of the firm

Non-financial factors

It has been identified from the sustainability report of the firm that the company has failed to properly utilize its resources available in the market. This has been the basic reason for the increase in cost and decline in profitability of the business. The company has failed to implement a marketing and product orientation strategy to promote its product in the market. As a consequence of this inventories of the firm has remained unsold in 2022. This has declined the efficiency of the firm in the last year.

Part three: Sustainability reporting

The sustainability development in the Boohoo Group Plc has been analyzed with the valuation of the required step taken by the company based on the social aspect. It has implicated major social work which is related to conducting changes in the way of operating required work and developing proper work based on effective changes in the society and environment in an appropriate way (Hoosainet al. 2020). The sustainability report of the Boohoo Group Plc has implied that the company has taken integrated steps toward changes in the labor cost after the impact of Covid in the UK. The evaluation of the sustainable development in the company is not effective. The required “labour scandal in 2020” is one of the major aspects that reflect that has not had a good enough sustainable position in the market (boohooplc.com, 2023). The Labour Scandal has implied the major allegation that the company paid minimum wages to their laborers while skimping on the required safety precautions at their factories.

Figure 6: Work process for sustainable growth of Boohoo Group plc

(Source: boohooplc.com, 2023)

The above figure has mainly reflected the proper plan that has been prepared by the company in order to sustainable development in the work. The use of the above work cycle with effective work development can help in bringing transparency in fashion. The high-priority work for sustainability has been estimated by the company and implicated in the company’s official sustainability report. The major priority of the company is analysed as “Diversity & Inclusion, Product quality & safety, and Supporting local communities”. The use of these aspects has critical implications for meeting adequate sustainability work (Lim, 2022). The development of “Diversity and inclusion” is the major aspect that has the required aim to reduce discrimination related to “age, gender, ethnicity, religion, disability, sexual orientation, education, and national origin”. On the other hand, development of the product quality is another effective work that can mainly provide safety to the consumers and have adequate satisfaction as well. Support to the local community has been implied by taking part in social activities that can impact “people's health, well-being, and prosperity” (boohooplc.com, 2023).

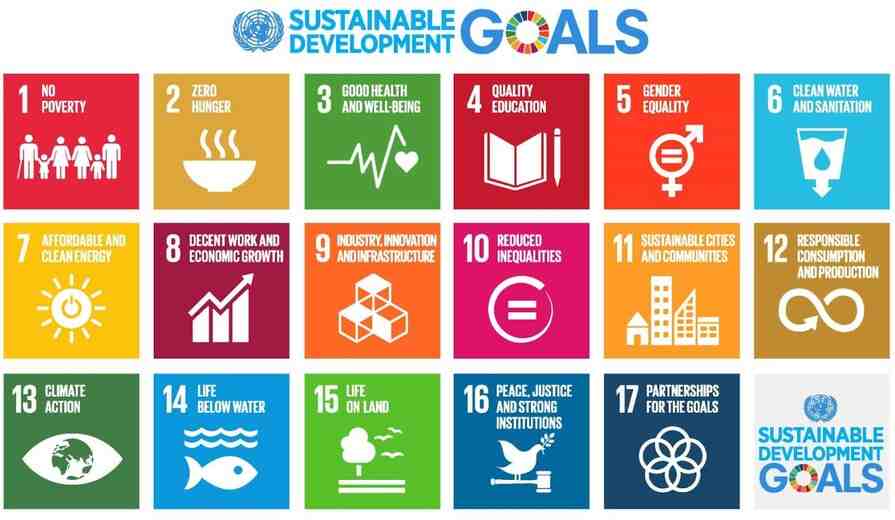

“United nation sustainable development goals (SDGs)” mainly provided 17 goals which are implied taking the proper steps that have implicated in changing social work and “transform the world from the disabilities”. The valuation of the required steps taken by the Boohoo Group Plc which is complied with and related to the UN sustainable goal has clearly analysed with the implication of the adequate work valuation in the company. The relevance of the work activity of the company toward the sustainable goal of the company is the required aspect that has helped in better position development in the market.

Figure 7: “UN Sustainable Development Goals”

(Source: unfoundation.org, 2023)

The above figure has clearly stated the 17 goals that have been included in the UN sustainability. The evaluation of those 17 goals has implied conducting the organizational work in an appropriate way. The evaluation of the work activity of the company has implied that the company has planned to conduct work on “Goal 3: Good health and well-being, Goal 5: Gender equality, goal 9: industry innovation and infrastructure, Goal 10: reduce inequality and Goal 11: Sustainable cities and communities”. The development of those goals has been implied by the company in the better improvement and completion of the work in an appropriate way.

The relevance of the company's priority in sustainable development is one of the major aspects that create a proper impact on stating relevance with the UN sustainable goal in an appropriate way. It has critically implied in the stability report of the company that it has taken step toward the development of “Diversity and inclusion”. Based on the research work of Hassaniet al. (2021), the required work in “Diversity and inclusion” has relevant to the few UN sustainable goal. The inclusion of “Diversity and inclusion” has implied establishing gender equality in the workplace and reduction of the inequality related to several aspects. The development of the required health and safety of the consumers is another relevant fact that is similar to the UN sustainability goal. The valuation of the changes in the way of providing health-related safety can initiate into consideration required changes in the work activity of the company.

Part four: Reflective Practices

I have mainly used financial and nonfinancial knowledge that has helped in conducting this assessment in a more effective way. Moreover, critical thinking and research on the valuation of a company's sustainable development are also used at the time of completing this assessment.

The sustainability report is mainly the communication and required disclosure of environmental, social, and governance (ESG) goals that have been accomplished by the company for effective development and progress. The valuation of the required steps taken by the company for changes in the activities of ESG is the required aspect that help in the proper development of the company.

Do you think sustainability developments are important in accounting education and why? (50 words)

accounting?

Sustainability development is important in accounting education as it is the type of effective tool that can help in properly analysing, accumulating, and managing ESG-related risk. I am believing that it can help in identifying major resource efficiency and proper cost saving. It can also help in establishing links for improvement in analyzed social and environmental issues with the required use of financial opportunity.

Looking at the company’s annual reports you have selected, how do you perceive this assessment has contributed to your knowledge of sustainable reporting? (50 words

The selected annual report of the company has critically enhanced my knowledge of the ineffective conduction of work that has a negative impact on sustainable development in the environment. I have recognized that the company has major issues related to developing work regarding environmental aspects and this has increased my overall knowledge while preparing a sustainable report

The sustainable report for the company is mainly prepared for their stakeholders that are related to the company. The major stakeholders have mainly included "customers, consumers, employees, suppliers, insurers, lenders, investors, and society". These are the required users who really care about the sustainable report and make an effect on conducted work by the company as well.

References

Boohooplc.com, 2022. About the company [Online] available at: https://www.boohooplc.com/group [Accessed on: 16th March 2023]

boohooplc.com, 2023 boohoo-sustainabilty-report-2021 Available at: https://www.boohooplc.com/sites/boohoo-corp/files/boohoo-sustainabilty-report-2021.pdf

Boohooplc.com, 2023. Annual report of Boohoo Group plc [Online] available at: https://www.boohooplc.com/sites/boohoo-corp/files/2022-05/boohoo-com-plc-annual-report-2022.pdf [Accessed on: 16th March 2023]

De Vito, A. and Gómez, J.P., 2020. Estimating the COVID-19 cash crunch: Global evidence and policy. Journal of Accounting and Public Policy, 39(2), p.106741.

Finance.yahoo.com, 2023. Financial summary of Boohoo Group Plc [Online] available at: https://finance.yahoo.com/quote/BOO.L?p=BOO.L&.tclass="lazy" data-src=fin-srch [Accessed on: 16th March 2023]

Hassani, H., Huang, X., MacFeely, S. and Entezarian, M.R., 2021. Big data and the united nations sustainable development goals (UN SDGs) at a glance. Big Data and Cognitive Computing, 5(3), p.28.

Hoosain, M.S., Paul, B.S. and Ramakrishna, S., 2020. The impact of 4IR digital technologies and circular thinking on the United Nations sustainable development goals. Sustainability, 12(23), p.10143.

Husna, A. and Satria, I., 2019. Effects of return on asset, debt to asset ratio, current ratio, firm size, and dividend payout ratio on firm value. International Journal of Economics and Financial Issues, 9(5), pp.50-54.

Kadim, A., Sunardi, N. and Husain, T., 2020. The modeling firm's value based on financial ratios, intellectual capital and dividend policy. Accounting, 6(5), pp.859-870.

Lim, W.M., 2022. The sustainability pyramid: A hierarchical approach to greater sustainability and the United Nations Sustainable Development Goals with implications for marketing theory, practice, and public policy. Australasian Marketing Journal, 30(2), pp.142-150.

Nižetić, S., Djilali, N., Papadopoulos, A. and Rodrigues, J.J., 2019. Smart technologies for promotion of energy efficiency, utilization of sustainable resources and waste management. Journal of cleaner production, 231, pp.565-5

unfoundation.org, 2023 United nation sustainable development goals (SDGs) Available at: https://unfoundation.org/what-we-do/issues/sustainable-development-goals/?gclid=Cj0KCQjwlPWgBhDHARIsAH2xdNdpdh3n9DGT6zds7ZwjXGiFSfOkytzrAEK4CISyXgpUL56chiKyjyMaAuXsEALw_wcB