- Introduction Of Fundamentals Of Healthcare & Finance Assignment

- Assessment Task 1

- a) Recent Developments in the financial and legal environment of health and social care

- b) Discussion on best suited funding option for health and social care sector

- Assessment Task 2

- a) Financial Statement Review for BUPA Group

- b) Investment Appraisal and Capital Budgeting

- Assessment Task 3

- a) Explanation of Processes needed to be considered for preparation of financial statements

- b) Evaluation of Debt Ratio and Solvency Position of BUPA group

- c) Critical Appraisal for role of traditional finance function for healthcare organisations

- i) Budgeting

- ii) Management of Receivables and Payables

- iii) Management of Operational Records

- iv) Determination of Financial Positioning

Introduction Of Fundamentals Of Healthcare & Finance Assignment

Struggling with complex assignments? New Assignment Help is here to alleviate your academic stress. With our online assignment help in the UK, students can access personalized assistance and guidance at every step. Don't forget to explore our Free Assignment Samples for valuable insights and ideas.

Assessment Task 1

This assessment task shall consider the fruitful discussions for undermining the recent developments in health and social care service delivery as well as enable the discussion for best suited and available sources of finance for the social care sector.

a) Recent Developments in the financial and legal environment of health and social care

The key development that can be linked with the financial and legal environment of health and social care in the UK consists of determining implications caused due to the UK's exit from the European Union. A high-scale overhaul in the health and social care operational dynamics has been observed in the recent day and age which therefore imposes concerned organisations to restructure man force. As per illustrations and explanations of Bisogno and Donatella (2022), the restructuring of man force is perhaps a worrying concern for health and social care organisations as it could lead to daily operational deficiency. Moreover, the legal environment associated with it is also likely to be tarnished as labour laws could jinx the business command and direction for a health and social care organisation. Hence, a mass-scale rejig in the employment prospects is a plausible development which has taken place recently in the UK thereby influencing the financial and legal environment in an indifferent manner.

The second key development that could be perhaps associated as a recent development in health and social care is considered to be associated with determination of a higher budgetary allocation and spending for health and social services. Approximate estimations suggest that a 1.6% increase has been observed for health spendings by the NHS (health.org.uk, 2019). Hence, it can be considered that a higher emphasis is being laid to ensure that healthcare services provided and offered contain top-notch specifications in order to improve lifespan and longevity of individuals. The legislative and the legal binding associated with an increased spending in the NHS can also be tracked based on constituting strong ethical health and social care SOP’s. This has been installed in the light of covid-19 pandemic, to encourage higher efficiency in mitigating covid-related infections as well as to increase recovery rate of covid infected patients.

The third key development that can be traced in terms of financial and legal relevance for health and social care in the UK is considered to be related with factors such as geographic segmentation and technology. Development of geographic segmentation is perhaps considered to be arduous as the nature of services offered to patients belonging to backward areas has been conceived as poor (Milana and Ashta, 2021). However, constant upgradation and remodelling in the technological aspect is being witnessed in recent years, suggesting a better transitional phase in the health and social care in future. Perhaps the legal aspects associated with geographic segmentation can be traced based on raising a high awareness as to how healthcare and generic social services are needed to be catered across every hook and nook of the UK. The legal aspects associated with technological development are mostly associated with facilitation of appropriate permits and licences for healthcare manufacturing companies without compromising requisite services that are needed to be offered to patients infected with various diagnoses.

b) Discussion on best suited funding option for health and social care sector

The discussion on funding options shall be conducted based on discussing the sources of finance, its advantages and the best suited for the social care sector.

i) Three Main Sources of Finance

Debt

Debt is considered to be the primary source of finance in which financial resources are mainly obtained in the form of loans and borrowings. As stated and idealised by Vosylis and Erentaitė (2020), the debt source of finance is perhaps considered to be a complex option of procuring funds which requires extensive background check of borrowers from whom finance is needed to be extracted.

Equity

Equity is considered to be the second important source of finance where financial resources and requirements are fulfilled through issuance of shares. Rai et al. (2019), narrated and viewed that shares could be issued either ordinarily or by issuing preference shares. This form of finance mostly allows restructuring of capital composition for an organisation intending to seek funds through equity as a viable source.

Crowdfunding

Crowdfunding is deemed to be the third major source of finance in which financial obligations are met through accumulation of small investment pools. The crowdfunding source of finance is perhaps conceived to be a highly popular source of finance in the current day and age where technological role is being emphasised highly.

ii) Advantages of Three main sources of finance

Debt

Main advantages of procuring finances through debt is considered to be related with harmonising the leverage prospects for an organisation. The harmonisation of leverage prospects is deemed to be an affluent factor that allows funding propositions that are available in abundance. The second advantage of debt is associated with allowing an organisation to retain complete ownership and authority of business paradigms and operations.

Equity

The main advantage of equity source of financing is considered to be related with benefitting organisations to welcome a higher acquisition of funds at a relatively lesser time. Moreover, equity source of financing can also be clubbed with grants and government aids to attract a higher external stakeholder influence with a particular organisation seeking funds.

Crowdfunding

The main advantage associated with raising funds through crowdfunding is considered to be related with allowing an organisation usage of social media tools rather than employing a traditional approach in raising funds (Bai and Collin‐Dufresne, 2019). Moreover, crowdfunding is also deemed to be advantageous as it allows fund infusion at a constant basis thereby nullifying shortage of financial resource supply.

iii) Best fit source of finance for social care sector

Ideally, the best fit source of finance for the social care sector is considered to be associated with raising funds through equity. This is deemed to be beneficial as equity source of financing encourages faster procurement of finances to necessitate better provision of healthcare and social services. The associated cost of finance is also null in this mode of finance which also allows better operational dynamics for health and social care organisations to maximise revenues and insurance payouts.

Assessment Task 2

This assessment task shall further enable the suitable determination of financial statement review of BUPA group as well as evaluate capital budgeting and investment appraisal propositions. The financial statement review shall be contemplated based on calculation of Return on Equity while investment appraisal shall be substantiated based on findings from NPV and IRR.

a) Financial Statement Review for BUPA Group

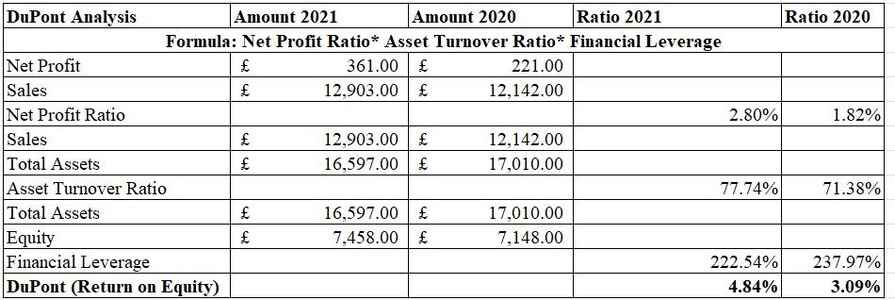

The financial statement review for BUPA Group will be determined by calculating DuPont Analysis as well as a suitable discussion on usefulness of DuPont analysis and business viability shall be sufficed.

i) Calculation and Analysis of Return on Equity using DuPont Analysis

Figure 1: Computation of Return on Equity for BUPA Group Using DuPont Analysis

(Source: Created by Learner)

According to the above figure of return on Equity calculations using the DuPont Analysis method, it can be observed that ROE for 2021 and 2020 has been calculated as 4.84% and 3.09% respectively. The stipulated industry average of ROE as per available metrics belonging to the healthcare industry is considered to be 11.6%. Thus, it can be established that the ROE for Bupa Group is significantly lower as compared to ROE for the industry. As per illustrations and expressions of Kraus et al. (2020), a low ROE is perhaps a worrying factor for organisations when net profit is lower which could potentially lead to future investor backouts.

ii) Discussion on Usefulness of DuPont Analysis for decision-making and business viability

Usefulness of DuPont

The key usefulness of DuPont Analysis is considered to be associated with allowing investors to possess a detailed financial overview of an organisation before strategising investment prospections. Zahra and Anoraga (2021), viewed and opined that DuPont analysis is also considered to be beneficial to encourage investors to identify any potential financial strengths and weaknesses prevailing for an organisation.

Business Viability

According to above conducted analysis and calculations, the ROE for BUPA group has been identified as significantly lower when compared with industry prescribed benchmarks. Thus, the business does not seem to be viable as future investment propositions are expected to remain bleak thereby diluting healthy investor participation with BUPA group.

b) Investment Appraisal and Capital Budgeting

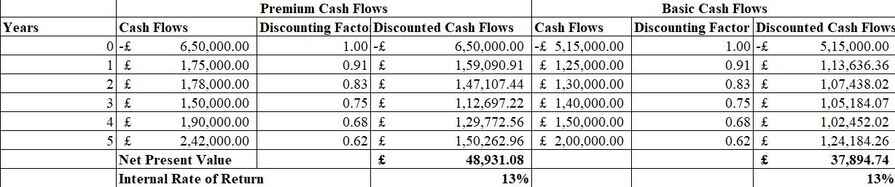

The investment appraisal and capital budgeting section of this task shall emphasise calculations and analysis from NPV and IRR methods as well as recommend the service offering which should be implemented by BUPA Group.

i) Evaluation of investment options using Net Present Value Technique

Figure 2: Calculation of Net Present Value for Service Offerings

(Source: Created by Learner)

According to the above demonstrated figure of calculations for determining the Net Present Value, it can be established that the NPV for premium cash flows has been calculated as GBP 48,931.08. Subsequently, the net present value for basic cash flow service offerings has been calculated as GBP 37,894.74. Therefore, it can be established that the NPV for premium cash flows is marginally higher than the NPV of basic cash flows. Heald and Hodges (2020), expressed and observed that high NPV are a strong indicator that encourages organisations to select a particular project.

ii) Evaluation of investment options using the Internal Rate of Return Technique

Figure 3: Calculation of Internal Rate of Return for Service Offerings

(Source: Created by Learner)

As per the above demonstrated graphical representation of internal rate of return, it can be ascertained that IRR for premium cash flows has been calculated as 13%, while IRR for basic cash flows has been calculated as 13%. Therefore, a similar IRR has been obtained for both service offerings that are available to BUPA group. As per explanations and narrations of Bernile et al. (2021), ideally a project is considered to be appealing when IRR is greater than the cost of capital or discounting rate.

iii) Recommendation for selecting a specific investment option

As per above calculations of both NPV and IRR, it is advised and recommended to the management of BUPA Group to select Premium cash flows as the most plausible service offering. The justification offered for selection of premium cash flows is purely based on the fact that NPV for premium cash flows is marginally higher than basic cash flows. Moreover, the optimistic chances of maximising business operations also remain at a higher stead when this service offering is prioritised and implemented at the earliest.

Assessment Task 3

In addition to Assessment Task 1 and Assessment Task 2, Assessment Task 3 shall emphasise upon explanation of processes needed to be considered for preparation of financial statements. Moreover, evaluation of debt ratio and solvency position of BUPA group as well as critical appraisal of the role of traditional finance function shall also be briefly discussed in this assessment task.

a) Explanation of Processes needed to be considered for preparation of financial statements

The explanation of processes needed to be considered for preparation of financial statements shall consider the following eleven steps that an organisation is required to emphasise for fruitful presentation of financial statements on an annual basis.

i) Journal Entries

Journal entries are considered to be the primary important step needed to be emphasised by an organisation to prepare and present accurate financial statements. Journal entries are also termed as the gateway to financial statements as primary recording of transactions and the accounts in which effect is being made is established. The balances acquired from journal entries are further transferred to the second step or set of accounts known as the ledger accounts.

ii) Ledger Accounts

Ledger accounts bring forward the balances of journal entries and is deemed to be the second important step associated in the preparation of financial statements. As per explanations and observations of Boubaker et al. (2022), ledger accounts are also known as T-accounts where individual account balances are being established during a financial year. The arrived actual balances of ledger accounts are subsequently transferred to trial balance where a preliminary statement of accounts is being prepared.

iii) Trial Balance and Adjustments

The third step associated with the preparation and presentation of financial statements is considered to be related with trial balance and adjustments. Trial balance helps to demonstrate a preliminary statement of accounts and their respective balances where accounts are being classified based on either debit or credit form of accounts. Omissions, errors and adjustments are also ascertained and detected after preparation of trial balance which are subsequently incorporated and rectified accordingly by organisations to solidify preparation of financial statements.

iv) Income Statement

Income statement is considered to be the fourth important step or process involved in preparation of financial statements. The preparation of an income statement is generally conducive as it ascertains the overall manufacturing and operating costs incurred by an organisation with respect to sales revenue generated during a particular financial year (Keloharju et al. 2022). The income statement also ascertains profitability from manufacturing and operations which are colloquially termed as “gross profit, operating profit as well as net profit”.

v) Balance Sheet

Balance sheet is considered to be the fifth important step associated under the preparation of financial statements where final balances accumulated through trial balance are being brought forward. The balance sheet is a precise indicator of all asset and liability balances appearing during a financial year for an organisation. Moreover, the balance sheet is also deemed to be the most important statement of financial position as a high investor-orientation is attached when an appropriate balance sheet is being presented by a company.

vi) Cash Flow Statements

Cash flow statements are considered to be the sixth important step associated under preparation of financial statements where final cash balances available for an organisation are detected. Henager and Cude (2019), idealised and opined that cash available for an organisation can be identified on the basis of three key activities including operating, investing as well as financing. The final balance retrieved from the cash flow statement is subsequently transferred to the current assets side of the balance sheet and is labelled as cash and cash equivalents.

vii) Comparative Analysis Tools

Comparative analysis tools are perhaps considered to be the seventh important step associated with preparation of financial statements. In order to compare financial performances, the most common tools available to be exercised by an organisation include ratio analysis, vertical analysis as well as horizontal analysis. This analysis can be facilitated for yearly performance assessments as well as assessment of performance with industry competitors of an organisation.

b) Evaluation of Debt Ratio and Solvency Position of BUPA group

Figure 3: Computation of Debt Ratio and Debt to Equity Ratio for BUPA Group

(Source: Created by Learner)

According to the above demonstrated figure of calculations for debt and debt equity ratio of BUPA group, it can be obtained that debt ratio for 2021 and 2020 has been calculated as 41.71% and 45.34% respectively. The ideal benchmark stipulated for determining the debt ratio for the healthcare industry is considered to be 35%. Hence, the performance of debt ratio for BUPA group is considerably higher than the industry stipulated benchmarks. As per illustrations and explanations of Yang et al. (2019), the higher debt ratio can be mostly accumulated when high emphasis is being offered by a company to maximise leverage. Thus, the debt ratio is deemed to be in a healthy state for BUPA group which further encourages the company to expand its business scalability opportunities.

The determination of solvency position for the company concerned BUPA group can be further ascertained based on considering the calculations obtained through debt-to-equity ratios. The debt-to-equity ratio for 2021 and 2020 has been calculated as 92.83% and 107.90% respectively. Ideally, the debt-to-equity ratio should be ranging between 100 to 150% for healthcare organisations (Cosci et al. 2020). This further emphasises that the debt-to-equity ratio for the company is mostly in line with the industry prescribed standards. Sufficient returns can be facilitated to the concerned investors and external stakeholders to ensure that a better financial overview for BUPA group is thoroughly achieved. Therefore, the overall solvency positioning for the company is mostly considered to be in a healthy and affluent manner which thereby encourages high investor traffic for future investment purposes.

c) Critical Appraisal for role of traditional finance function for healthcare organisations

The role of finance or traditional finance function for healthcare organisations is considered to be an important and a significant area of interest which is needed to be prioritised to achieve better organisational prospects. As per explanations and narrations of Maxfield and Wang (2021), the role of finance function can be further ascertained based on key activities required for maintaining a better financial record and overview. Following is a detailed illustration of activities responsible for making finance function a significant area of interest.

i) Budgeting

Budgeting is considered to be the primary activity prescribed under traditional finance functions that is needed to be facilitated by healthcare organisations. As expressed and idealised by Qi and Ongena (2019), budgeting allows determination of how much an organisation could spend with respect to available financial and non-financial resources. However, the critical aspect of budgeting is deemed to be related with a higher variability between actual and budgeted performances.

ii) Management of Receivables and Payables

Management of receivables and payables is considered to be the second activity under financial functions where a healthcare organisation is required to maintain a proper tracklog of debtors as well as creditors. Jiang et al. (2019), critically expressed that management of receivables and payables is often neglected by organisations leading to indifferent cash operating cycles. Thus collection from debtors and payment to creditors made on part of medical organisations is generally indifferent.

iii) Management of Operational Records

Management of operational records is considered to be the third vital activity under financial functions. Operational records could constitute patient records, doctor records, records of pharmacy and medical supplies. As critically narrated by Fama (2021), management of operational records using a traditional method of maintenance is generally lacklustre leading to inappropriate and mismanagement of vital data and information for patients and other healthcare oriented services.

iv) Determination of Financial Positioning

Determination of financial positioning is deemed to be the fourth important activity listed under financial functions applicable for a medical organisation. The determination of financial positioning takes into consideration annual revenues and profitability generated along with statements of assets and liabilities possessed. However, the critical aspect of determining financial positioning is considered to be linked with a high time constraint required to be invested for suitable presentation of financial positioning.

Reference List

Journals

Bai, J. and Collin‐Dufresne, P., 2019. The CDS‐bond basis. Financial Management, 48(2), pp.417-439.

Bernile, G., Bhagwat, V., Kecskés, A. and Nguyen, P.A., 2021. Are the risk attitudes of professional investors affected by personal catastrophic experiences?. Financial management, 50(2), pp.455-486.

Bisogno, M. and Donatella, P., 2022. Earnings management in public-sector organizations: a structured literature review. Journal of Public Budgeting, Accounting & Financial Management, 34(6), pp.1-25.

Boubaker, S., Dang, V.A. and Sassi, S., 2022. Competitive pressure and firm investment efficiency: Evidence from corporate employment decisions. European Financial Management, 28(1), pp.113-161.

Cosci, S., Guida, R. and Meliciani, V., 2020. Does trade credit really help relieving financial constraints?. European Financial Management, 26(1), pp.198-215.

Fama, E.F., 2021. Contract costs, stakeholder capitalism, and ESG. European Financial Management, 27(2), pp.189-195.

Heald, D. and Hodges, R., 2020. The accounting, budgeting and fiscal impact of COVID-19 on the United Kingdom. Journal of Public Budgeting, Accounting & Financial Management, 32(5), pp.785-795.

Henager, R. and Cude, B.J., 2019. Financial literacy of high school graduates: Long-and short-term financial behavior by age group. Journal of Family and Economic Issues, 40(3), pp.564-575.

Jiang, L., Liu, J. and Yang, B., 2019. Communication and comovement: Evidence from online stock forums. Financial Management, 48(3), pp.805-847.

Keloharju, M., Knüpfer, S. and Tåg, J., 2022. What prevents women from reaching the top?. Financial Management, 51(3), pp.711-738.

Kraus, K., Kraus, N. and Osetskyi, V., 2020. New quality of financial institutions and business management. Baltic Journal of Economic Studies, 6(1), pp.59-66.

Maxfield, S. and Wang, L., 2021. Does sustainable investing reduce portfolio risk? A multilevel analysis. European financial management, 27(5), pp.959-980.

Milana, C. and Ashta, A., 2021. Artificial intelligence techniques in finance and financial markets: a survey of the literature. Strategic Change, 30(3), pp.189-209.

Qi, S. and Ongena, S., 2019. Will money talk? Firm bribery and credit access. Financial Management, 48(1), pp.117-157.

Rai, K., Dua, S. and Yadav, M., 2019. Association of financial attitude, financial behaviour and financial knowledge towards financial literacy: A structural equation modeling approach. FIIB Business Review, 8(1), pp.51-60.

Vosylis, R. and Erentaitė, R., 2020. Linking family financial socialization with its proximal and distal outcomes: Which socialization dimensions matter most for emerging adults’ financial identity, financial behaviors, and financial anxiety?. Emerging Adulthood, 8(6), pp.464-475.

Yang, Q., Wang, Y. and Ren, Y., 2019. Research on financial risk management model of internet supply chain based on data science. Cognitive Systems Research, 56, pp.50-55.

Zahra, D.R. and Anoraga, P., 2021. The influence of lifestyle, financial literacy, and social demographics on consumptive behavior. The Journal of Asian Finance, Economics and Business, 8(2), pp.1033-1041.

Websites

health.org.uk, 2019 Social Care Spending [online], Available at: https://www.health.org.uk/publications/long-reads/health-and-social-care-funding [Accessed on: 15.03.2023]