- Introduction Of Accounting For Leaders Assignment Sample

- EasyJet Plc

- Ratio analysis of the company with financial interpretations

- Recommendation of future strategies helping to improve the organizational sustainability

- Discussion of the literature review on budgeting practices

- Evaluation of techniques for investment appraisal

Introduction Of Accounting For Leaders Assignment Sample

Presentation of different prospects of accounting to the leaders of the organisation benefits the senior management to have closer insights from the financial perspectives to make critical decisions. This assignment has significantly shed light on the financial research for “EasyJet Plc” a “public listed company” in the UK belonging to the aviation industry. It has been required to analyse and evaluate the annual reports of EasyJet Plc for the financial years 2018 and 2019 to interpret the accounting policies and standards utilised. Furthermore, the calculation of financial ratios at interpreting that same has helped provide key insights into the financial performance in comparison to a competitor, British airways. A theoretical context of the budgeting practices leading to the4 enhancement of organisational performance has been illustrated with the providence of “investment appraisal techniques” to acknowledge the leaders using accounting processes in making better investment decisions.

Choose New Assignment Help for all your assignment needs in the UK. Our dedication to customer satisfaction and academic integrity sets us apart as a trusted partner in your educational journey.

EasyJet Plc

Easyjet Plc is identified as “Europe's leading short-haul airline” headquartered in London and the company is popular for its cost advantages, leading positions and operational efficiency in primary airports. Based on the insights of the annual reports the plan Easyjet mentions is to become “Number one or number two in primary airports”, to win the customer’s loyalty, value by operational efficiency, include the right people and bring innovations with data (Easyjet, 2022). The company has made a significant focus to deliver long-term values to its stakeholders. In 2018, “key performance indicators” revealed, total revenue at £5898 million having £445 million profit and 118.3p EPS increasing from 82.5p in 2017 (Corporate.easyjet, 2018). However, in 2019, the finances increased to become £6385 million in revenue, £430 million in profit and total seats flew 105 million (Corporate.easyjet, 2019). Thus, the prevailing micro and macro-economic business conditions had improved for Easyjet making it the most valuable organisation.

Figure 1: Financial highlights of EasyJet Plc in 2019

(Source: Corporate.easyjet, 2019)

Application of “theory of practice” for effective financial management

This section of the assignment has focused on the application of theories that can be implemented with organisational practices. It is possible to infer the required concepts with a demonstration of a meaningful understanding of the concepts regarding accounting standards as well as accounting policies. Furthermore, it is required to reflect on the implication of the mentioned standards and policies on the macro environment and financial environment of the chosen organisation. Moreover, a critical debate can be referred to in this case concerning the use and misuse of financial data applicable to practices of management and financial accounting. The discussions are made in compliance with accounting standards where discussions reflect the executed plan leading to “effective financial management” in EasyJet Plc.

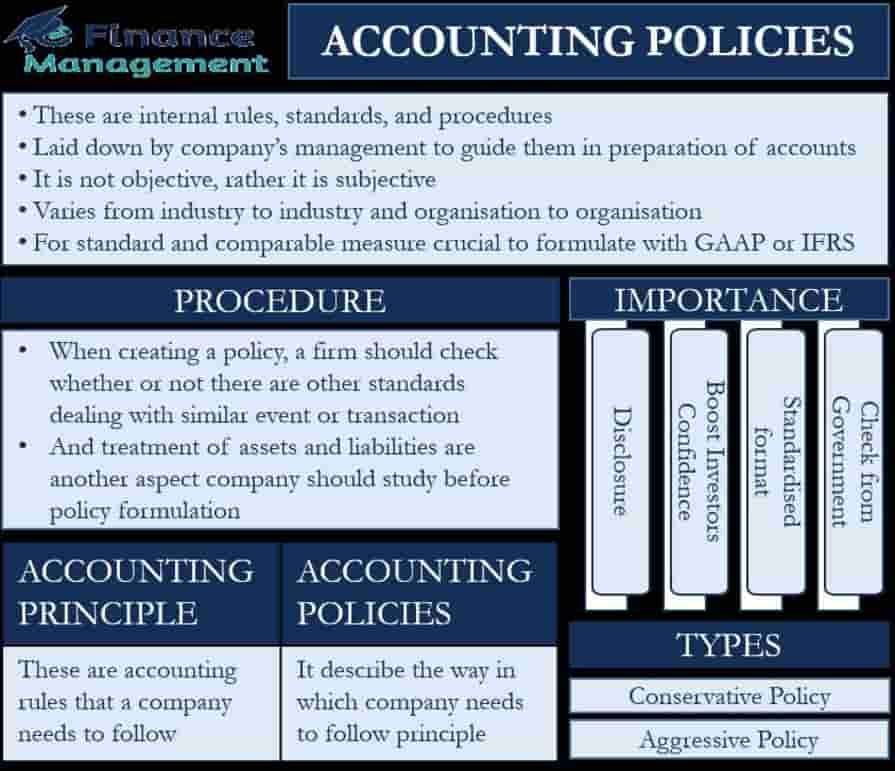

Demonstration of accounting policies & standards

Accounting policies can be referred to as the specified principles, conventions, bases, practices and rules which are applied to different organisations in the preparation and presentation of financial statements. Based on the opinion of Lutsyk et al. (2020), accounting policies are significant as they help in setting a critical framework which is followed by an entity along with the providence of financial statements. The statements can be deemed as comparable as well as consistent for the construction of final accounts across different financial years in relation to other companies. Implications of accounting policies on the financial environment mention providing benefits to investors as statements reflect the financial performance of different companies. It impacts the macro-economic environment by initiating the practice of “International Financial Reporting Standards” IFRS or “Generally Accepted Accounting Principles” GAAP while the companies prepare for financial statements. It helps the government in keeping a check on their financial statements with simultaneous protection for the investor's interests.

Accounting standards can be further identified as the major set of rules and guidelines which apply to companies in the creation of financial statements. Worldwide, companies either utilise “International Financial Reporting Standards” IFRS or “Generally Accepted Accounting Principles” GAAP to frame their financial accounts. In this case, it can be mentioned that IFRS can be referred to have more principle basis which can help to capture better the economic dimension of a business's transaction. On the contrary, GAAP can be referred to as an approach based on rules. From the financial context, accounting standards are advantageous in the preparation as well as presentation of the company’s financial statements. This is further significant for the investors helping them to better interpretations of the company's financial statements.

Figure 2: Brief idea of accounting policies

(Source: Garbowski et al. 2019)

Critical discussion of use and misuse of financial data in accounting management practices

The practices underlying accounting management relate to significant systems that help enable companies to generate essential information. As mentioned by Pavel (2021), the practices involve budgeting processes, “reporting and controlling”, followed by measurement of performance along with the costing of the products that assist to make managerial decisions. Thus, the creation of financial statements can be considered a key practice incorporated into accounting management. A manipulation of the financial statements indicates committing fraud against the company investors for creating falsified financial insights to manipulate the investment options. As the companies utilise GAAP to construct the financial statements it can be referred to as being flexible as well as open to generate interpretations by the financial managers of the company. The financial management team can therefore fudge the numbers which become difficult to get detected resulting in manipulation of the financial data that might affluence the financial statement and create falsified expectations for investors.

Financial statements are injected with the use and misuse of financial data because at times the financial performance of an organisation is in direct relation to the “compensation of corporate executives”. Accounting data are utilised for the prediction of financial performance in the forecasted future along with the information of the same are helpful in analysing overall business performance. As per LEN and GLIVENKO (2019), there exist major small business proprietors who review the accounting information on “a monthly basis” after comparing the actual versus budgeted sales, and expenditures, along with profit performances. Therefore the misuse of financial data thus creates serious challenges for the business in projecting their performance and making falsified expectations for forecasted financials.

Discussion of “effective financial management” in EasyJet Plc

Effectiveness projected for financial management processes incorporates major milestones like “planning, organising, controlling and monitoring” the financial resources to achieve the business objectives. The chosen company in this assignment is EasyJet Plc which is belonging to the aviation industry in the UK for which it is required to conduct a critical discussion to impart financial management practices. This is important as it will help the company to provide assistance to acquire as well as manage the funds thereby resulting to help in fund allocations (Zaytsev et al. 2021). Furthermore, it will provide key insights from the financial perspectives in making critical decisions by cutting down projected financial costs. The development of a plan from the financial prospects requires to be executed that help to guide the daily decision-making process for a business.

This will be significantly helpful for EasyJet Plc as the development of a financial plan will forecast the base of the financial numbers on actual results. As highlighted by AlShamsi and Nobanee (2020), it critically results in yielding significant information concerning the “overall financial health” as well as the efficiency of a business. The execution of constructing a good and viable financial plan helps to keep the focus on the tracks as this chosen company, EasyJet Plc grows whenever any new challenges create barriers on the growth pathway. With the assistance of a developed financial plan and execution of the same, the company will be capable of meeting unexpected crises that might hit the company while operating in a dynamic global market.

It can be mentioned in this case that recent situations like the advent of the pandemic caused by the widespread corona virus resulted in a volatile market situation. There were countrywide lockdowns and imposed travel restrictions from all the government bodies around the globe. EasyJet Plc belonging to the aviation industry had a direct impact on the travel restriction where its revenue lowered to generate losses during 2020 and 2021. Thus, a major hit of crises was experienced by this aviation company in the UK. However, with the assistance of a viable financial plan, it would have been possible that the company would not generate the losses that disrupted its financial position for consecutive years. The company would be assisted with acquiring along with managing the process of funds allocated that in return provides key insights in making essential financial decisions.

Ratio analysis of the company with financial interpretations

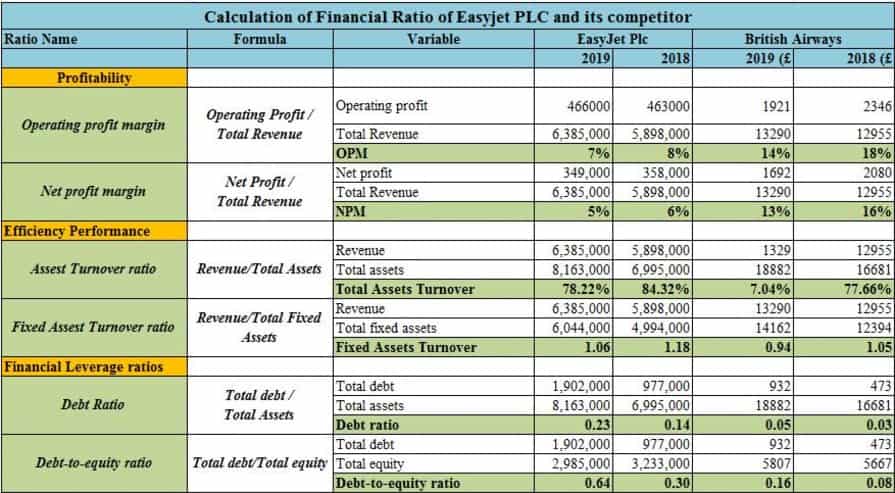

The estimation of financial ratios helps in understanding the financial performance of a company across specified accounting periods. Furthermore, ratio analyses are also conducted to compare the financial performance of two competitor companies operating within a similar industry. Ratio analysis projects a clear demarcation of the capabilities incorporated within competitor firms by estimating financial data (Campisi et al. 2019). In this section of the assignment, it has been asked to estimate the financial ratios for the chosen company which is EasyJet Plc in this case. In addition, a competitor firm has also been selected for which the estimated ratio analysis has helped in bringing about a comparative context to provide insights for both companies. The selected competitor firm of Easyjet Plc is British Airways which is also operating in the UK. The financial data has been derived from the annual reports concerning the financial years 2018 and 2019 for both the mentioned had been derived.

The ratios had been belonging to specific categories like profitability, efficiency, financial leverage and liquidity helping to infer the results generated from different perspectives for the chosen company as well as its competitor. As per the suggestions of Dance and Imade (2019), the conduction of financial ratios can be referred to as the financial metric which helps in the evaluation of critical business decisions made by financial managers. The comments on the business performance of both companies have resulted in the framing of suitable recommendations to ensure improvements in specific weakness areas. Thus, the interpreted financial results are supported with suggestive comments with a critical analysis based on macroeconomic development having an impact on the external environment. Thereafter the evaluation of future operational strategies was recommended for the improvement of organisational sustainability.

Estimation of the ratios and their financial interpretations

Figure 3: Estimation of the financial ratios for EasyJet Plc and its competitor British Airways

Profitability ratios

The reference to profitability ratios can be associated with a “class of financial metrics” which can be utilised for addressing assessment of a company’s ability (Husain and Sunardi, 2020). The profitability ratios reflect the businesses’ capabilities in the generation of earnings which is relative to the total revenue generated in a financial year. The profitability ratios are majorly estimated from the income statements constructed by a company that lists all the earnings and incomes generated by a company after operating. In the opinions of Miransyah and Dempo (2021), the estimation of profitability ratios indicates the successful attribute of a business to earn profits in relation to its “operation costs, revenue, and shareholders' equity”. A higher ratio from the profitability category reflects better performance reflecting that a company is highly capable of the generation of profits on a regular interval.

From the profitability context, the calculations for the “operating profit margin” for the client as well as the competitor firm reflected the generation of operating profit as a percentage of its annual sales. The margin is estimated with the formula “operating profit divided by sales” which was projected as 8% and 7% for EasyJet in 2018 and 2019 respectively. The revenue of the company increased from 5898 million GBP to 6385 million GBP in 2018 and 2019 respectively. However, the operating profits were 463 million GBP in 2018 becoming 466 million GBP in 2019, but the margin decreased in 2019. In comparison, the competitor, British Airways generated better results being their OPM being 18% in 2018 decreasing to 14% in 2019.

The “net profit margin” NPM generated by EasyJet was 6% which declined to 5% in 2018 and 2019 respectively. British Airways, on the other hand, generated an NPM of 16% in 2018 declining to 13% in 2019. Comparatively the profitability capacity of the competitor firm was better than the client firm in both 2018 and 2019. It can further be mentioned that the financial performance for EasyJet Plc declined in FY 2019 as the net profit generated reduced from 358 million GBP to 349 million GBP. The graph above illustrates the lower generation of “net profit margin” in Easyjet in comparison to the NPM generated by British airways. It can be recommended to Easyjet that they must focus on generating more sales by increasing the prices of airfares marginally, and by providing better offers to attract more passengers. Furthermore, the company requires decreasing the operational as well as the non-operational expenses to decrease the burden of the lower generated income.

Efficiency ratios

The estimation of different efficiency ratios helps measure the ability of a firm the utilisation of its listed assets for the future generation of income. As per the opinions of Minetto et al. (2018), the efficiency ratios critically focus on diverse aspects of a firm, for example, the time taken by the firm to the collection of cash amounts from its customers. The activities projections of the company are possible to be interpreted with the help of efficiency ratios highlighting the total time taken accompany to convert its accumulated inventory into liquid cash balances. Estimation of different efficiency ratios helps in the measurement of efficiency projected by a company for the utilisation purpose for generating revenues as well as its abilities in the management of the assets.

The calculation of “total assets turnover” reflects the capability of a company in the generation of annual revenue based on the number of total assets belonging to the financial position. The formula incorporated to estimate the “total assets turnover” was “revenue divided by total assets” and expressed as a percentage. In Easyjet plc the total asset was identified to be 6995 million GBP in 2018 increasing to 8163 million GBP in 2019, as projected in the balance sheet of the company's annual report (Corporate.easyjet, 2019). Thus, the results were generated as 84.32% decreasing to 78.22% in 2019 interpreting the efficiency of the company critically decreased in 2019 compared to 2018. It can be mentioned that in British Airways the percentages were projected as 77.66% in 2018 significantly decreasing to 70.38% in 2019.

Similarly the “fixed assets turnover” can be calculated based on the incorporated formula “revenue divided by total fixed assets”. This was projected for Easyjet plc at 1.18 in 2018 decreasing to 1.06 in 2019. On the contrary, in British airways, the ratio was projected as 1.05 in 2018 significantly declining to 0.94 in 2019 (Iairgroup, 2019). The conduction of efficiency ratio analysis helped in understanding the management crisis of the company after evaluating the business operations. These are specifically useful for the lenders and the investors who use the ratios while conducting financial analyses for different companies to decide whether it represents a better investment and creditworthiness.

In comparison to the results, it can be proclaimed that the efficiency ratios were comparatively better projected in Easyjet plc, however, the performance of this company decreased in 2019 compared to 2019. Comparatively, it can be interpreted that EasyJet Plc has better efficiency than British airways to generate revenues based on the total assets as well as the number of fixed assets encountered by the company. It can be suggested to the client firm they must increase the percentage of efficiency levels in generating better revenue amounts based on the amounts present in their financial positions.

Financial leverage ratios

Commonly the ratios conducted for financial leverage are termed debt ratios which help in the measurement of the ability that a business has in meeting its “long-term debt obligations”. The estimation of ratios concerning the financial leverage of a business reflects on the capital structure and growth perspectives of the business. If a company has a “higher financial leverage ratio” it indicates that the business normally utilises the debt capital forms for the financial process of its “assets as well as its operations”. Having a higher “financial leverage ratio” entails a sign that the business can be considered to be a riskier bet to any potential investor who wishes to invest in any company’s shares.

In the opinion of Ahmed et al. (2018), financial leverage indicates the usage of the debt capital that is involved within the capital structure of a company which can be utilised to purchase more company assets and fund regular operations. However, it can also be interpreted that an excessive percentage of financial leverage ignites to increase in the risks of failure in the payment of debt obligations. For Easyjet Plc and its competitor British Airways the financial leverage ratios have been estimated where calculations are made for debt ratio and debt-to-equity ratio for the financial years 2018 and 2019.

The debt ratio had been estimated as a ratio between the “total debt based on total assets amount” which was 0.14 in 2018 increasing to 0.23 in 2019 for Easyjet plc. Comparatively the debt ratio of British airways is lower being 0.03 in 2018 and 0.05 in 2019 respectively. The debt-to-equity ratio reflects the ratio between the debt capital and equity capital as projected from the company’s capital structure. This represents the gearing which was projected for Easyjet plc as 0.30 in 2018 increasing to 0.64 in 2019. Comparatively the ratio was 0.08 in 2018 and 0.16 in 2019 in British Airways. The estimation of the “financial leverage ratios” interprets that debt of Easyjet was higher compared to its competitor which has increased the debt obligations of the company. Furthermore, it can be interpreted that the client company finances its operations to a great extent with the involvement of debt capital.

Liquidity ratios

The liquidity ratio is used to assess the liquidity position of an organization. The liquidity position which is the amount of cash a company has in initial operation, be it in the form of cash and cash equivalent, can be measured from the3 accurate analysis of the ratio (Simamora and Hendarjatno, 2019).

In order to understand the liquidity in the hands of EasyJet plc and British Airways the current ratio and cash ratio has been computed for the year 2018 and 2019.

Current ratio

The current ratio of Easyjet for the year 2018 has been identified at 0.97 which further declines to 0.79 in 2019.

The current asset of Easyjet in 2018 was at 2001000 and the current liability at 206000 in 2019 was at 2119000 and 2668000.

The current ratio of British Airways in the u year 2018 was at 0.73 which moved slightly to 0.74 in the year 2019.

The current asset of the company in 2018 was at 4287 and cl at 5838 and CA. it increased to 4720 and CL. to 6390 in the year 2019.

The increased level of current assets and current liability of the companies dictates the incapability of both the companies to manage their cash and cash equivalents to meet their short-term liability. The current rate of Easyjet has seen downward progress which m c represents the company's ability to pay its short-term obligation to further decline in 019 compared to its previous year. Compared to its competitor organization the liquidity position of Easyjet is better however its position is declining.

Cash ratio

The cash ratio of EasyJet in 2018 was at 0.50 which further decreased in the next year to 0.48. The cash ratio of t British Airways has also seen decreasing trends as it declined to 0.20 in 2019 from 0.23 as it was in 2018. The cash position of Easyjet is higher compared to British Airways however both are witnessing a decreasing trend in the cash position. The decreasing cash ratio of the companies represents that h the companies are incapable of maintaining and reemployment their cash and cash equivalents in their business activities. The difficult cash position of the companies and the company’s capability to pay off its liabilities has decreased as well.

Recommendation of future strategies helping to improve the organizational sustainability

Based on the financial performance as projected from the conduction of ratio analysis for the client organization which is chosen from the aviation industry of the UK, Easyjet Plc. The results highlight that from all aspects of profitability, liquidity, efficiency and liquidity leverage, EasyJet has failed in performing successfully in 2019 compared to 2018 as well as from the competitors' context (Aziz and Shah, 2021). Therefore, it is suggested to the company focus on generating more sales by increasing the prices of airfares marginally, and by providing better offers to attract more passengers. Furthermore, the company also requires to decrease the operational as well as the non-operational expenses to decrease the burden of the lower generated income. It is recommended to lower its debt obligations and increase equity capital to lower the “financial leverage ratios”.

Discussion of the literature review on budgeting practices

The preparation of the budget of an organization is often considered to be the basis of the process of control management. The budget can be explained as the common accounting tool that organizations use to implement their plan and strategies. Plans and targets get assigned with monetary value through the process of budgeting and help in the measurement of the progress made by an organization. (Stanimirović and Klun, 2021) There are 7 kinds of budgeting used by the organizations such as strategic plan budgeting, master budget, and cash budget. financial budget, labor budget, operating budgets and capital budget are also some of the budgeting methods. The most common budgeting practices of companies are capital budgeting. Traditional and modern budgeting both come under the capital budgeting method.

Traditional budgeting approach

Traditional budgeting has faced several criticisms relating to its incapability of meeting the demand of the competitive business environment. The arguments however fall short in front of the strengths, viability and limitations of the traditional budgeting system.

Strengths

- It is a set of quantitative representations of the plan and action that has been proposed by the managerial department of the organization for a specific period.

- Induce planning aids the managers in setting goals for the organization that are realistic and makes playmaking at is required to achieve those goals. Budgeting enables the management to anticipate and prepare for situations.

- The proposal and agreement of the budgeting of an organization is an activity that requires coordination and communication. The traditional method is an endorser of effective communication and coordination.

- Budgeting is easier to evaluate the overall performance of the firm for a financial year if it is properly made and helps in decision-making (Klatzer et al. 2018).

- Budgeting is action based and the process makes the goals clear and the action needed for the achievement of the goals made clear and motivates the m employees.

Limitations

- The traditional budgeting system does have some disadvantages and they are discussed below.

- The budgeting practices are costly and can require a lot of time to put together.

- Traditional budgets can lack focus on the strategies, and can often contradict the goal of the company.

- The budgeting approach has some responsiveness constraints that can act as a barrier towards change.

- The values in traditional budgeting are done in the form of minutes

- The practice focuses on cost reduction rather than the creation of value.

- The updates and development are not frequent; generally, the budgets are updated annually.

- The approach has multiple assumptions and the strengths for commanding the control are vertically placed.

- The traditional budget has departmental barriers and this makes the sharing of knowledge difficult and the employees can often feel undervalued.

Viability

- Traditional budgeting is used universally by companies, 90% of the organizations used the budgets as a method to induce coordination, planning and activity evaluation and support the internal system.

- The managers largely prefer traditional budgeting in performing activities, planning and controlling and disregard the statement of its dysfunctionality.

- In addition, these companies do not indicate abandoning the traditional budgeting system in near future.

Proposed changes

According to the (Polzer et al. 2021) despite it being widely used academics have considered these it lacks perfection as it lacks in relevance with the modern business environment. Traditional budgeting no longer provides satisfaction and to address the m limitations of budgeting new approaches are proposed. The new approaches contract with the traditional budgeting processes used in the business is discussed below.

Activity-based Budgeting

This budgeting method provides the business with more transparency in terms of the budgeting process. Research and instructional activities are used to generate revenue for the business and the responsible activity of management is assigned to it for greater accountability and planning.

Rolling Budget

The rolling budget is an annual budget however it keeps rolling as it is updated frequently each month or quarterly. The rolling budget is the budget of the year and an additional month is included at the end of the month.

This traditional budgeting has the following methods-

The average rate of return

In this method, the rate of a verge return is used for evaluation of the life of a project using the accounting profit and the result is divided by the average investment.

ARR=(Average Profit after tax/Average Investment)*100

There is an accept and reject rule if the “average rate of return” that has been calculated is the rate of return that was desired in the project it will be accepted or it will be rejected.

Payback method

This method calculates the period by which the initial amount that has been invested in a project is recovered. Projects with shorter payback periods are considered to be profitable and are preferred on acceptance over projects with longer payback periods.

Modern budgeting approach

The budget is a summary of the variable forecast of the strategic and financial objectives of the management of a company. The budget is the navigational instrument that provides direction to the organization towards achieving the aforementioned objectives. Modern budgeting focuses on two elements in the development of budgets. These two elements are the development of the contingency plan of the organization and its profitability. Globalization has impacted the culture of organizations regarding their compelled management and revisions of their budgeting strategies.

The companies have witnessed a shift of paramount importance in leadership in the context of adopting modern budgeting techniques rather than conventional forecasting techniques. Traditional budgeting does not focus on contingency planning and it can be hard to coat.

The macroeconomic indicators, awareness regarding the competitive environment, wallet size, and market share are integrated with modern budgeting (Wijnen et al. 2020). Very limited items are considered variables that are volatile and can lead to changes in the number that has been forecasted.

In the current market, the stakeholders of the organizations are liable to closely watch the budget and its strategic planning evolutionary environment makes the budget consider and prepared for risk by contemplating the worst-case scenario within the budget.

The budgeting techniques used in the is also referred to as the planning of contingent reserve. The budgeting technique is the foreplay to the original plan of the budget and does not adhere to vulnerable economic shocks.

The shareholders have limited liability in the operation of the business similarly and have fewer commitments as well. The budgeting technique has some limitations as it talks about the cost and revenue of the business. Decision-makers are always geared up to utilize the available resources within the ambit.

Capital employment

It is inherent in companies to utilize their capital or equity on an adequate basis. The organization using the capital employment techniques required to be proactive and cautious on p guarding the access to its assets as it could impact the performance of the business. Internal and external forces can also affect the performance of the organization for some time. Compared to the conventional budgeting approach modern budgeting focuses more on the units and is all about the production capacity and increasing the same and enhancing the overall process of the business.

The budgeting approach of the company disregards the aspect of consumer experiences. In modern bus debating techniques, the frequency of the updates in the customer needs and the customization of products is warranted in the modern budgeting techniques rather than in the conventional approach.

The modern techniques of budgeting are relevant for all organizations including publicly listed companies such as Easyjet Plc and British Airways in this scenario. Modern budgeting considers both the tangible and intangible assets of the organization and takes required measures on meeting the satisfaction of the consumers.

The comparison of the techniques of modern and conventional management has revealed that modern techniques are more efficient and advanced than the latter (Ghiyasi, 2018).

These might be the reason that organizations in larger numbers are adopting or moving towards the modern budgeting approach. The modern approach can provide accurate measures of determining the productivity, performance, and efficiency of the companies along with the factors of consumer satisfaction all around the globe.

“Discounted cash flow technique”

Discounted cash flow methods are the methods used in the modern budgeting processes and this helps in the isolation of the t cash flow in the business. The cash flows are identified based on their timing and can be discounted as well to determine the present value of an investment in the project at the current time.

“Net present value method”

In this approach, the cash moving from the business is deducted from the present value of the cash moving in the business (cash inflow- cash outflow). If the value of the NPV is zero the project is not accepted as it does not satisfy the financial o objectives of the original action and affects the wealth of the shareholders negatively. In the case of several projects with s make initial investment amount they are ranked according to their NPV (Vierlboeck et al. 2019). The project with the highest positive NPV is preferred from the financial perspective and the remaining projects are ranked accordingly.

“Internal rate of return method”

The internal rate of return can be explained as the at which the cash outflow of the project at the represented value is equal to the cash inflow of the project at the present value. It is the value that can make the NPV of a project Zero and is also known as the yield from the “marginal efficiency of capital”, investment, “marginal productivity of capital” also rate of return.

“Modified Internal rate of return method”

Cash inflow during the life of a project is considered to have reinvested in the business in the method of NPV and IRR. The assumptions are made on the rate of IRR in the NPV method about the reinvestment. To omit the limitation, a Modified rate of return(MIRR) can be adopted by the decision maker. MIRR is an improvised IRR in the context of capital budgeting decisions.

“Profitability index method”

The evaluation of the decisions of capital budgeting under standard practices has created some potential biases. The consideration of proposals and assets with mutual exclusiveness, potential bias in accepting more expensive, cost different method amounts based on the larger size.

Evaluation of techniques for investment appraisal

Investment appraisal can be referred to as the router techniques used by firms utilizes and investors as well as the preliminary basis for the determination of accepting an investment project. The investors and the business calculate the profit-generating capacity of the investment before venturing into the investment (Okolelova et al. 2018). The assessment of the affordability and profitability of an investment project, machinery and new products of the long term will be measured from an investor's perspective. There are multiple techniques o used for the appraisal. The professionals often used the new techniques of the discounted cash flow NPV as an example switch technique. In this technique, the “ time value of money” is considered and given the most focus to get accurate results. There are also techniques a\s of Non-discounted Payback periods such as the method of appraisal. The payback period method often renders result with less accuracy the factor of the “time value of money“ is not incorporated in its calculations. Often investors use more than one method in getting a better insight into the investment opportunity.

Net present value method (NPV)

This method estimated the profitability of an investment and the difference of the cash outflow at present value from the cash inflow of bat present value in the period of the project. In case the difference is positive the project is profitable vice versa.

The proper assessment of the NPV process can be explained with the help of an example. The NPV of the investment of Easyjet Plc has been calculated in the assignment

(Marotta et al. 2022). The NPV value of an investment with a timeline of 5 years has been assessed along with the IRR. The initial stage is considered as 0 in the time flow in the form of years; the discounted factors have been considered to be 10%. In the first year, the cash outflow from the investment was £50000000 and which was the amount of the initial investment. The inflow from the first year was 12000000 which decreased the cumulative discounted cash flow to -39200000. The inflow o from the investment took 4 years to cover the initial investment of the project and generated a positive amount of 3426250. The Net present value at this time has been calculated as 4991711 but a discounted rate of 10%. The internal rate of return of the investment has been calculated at 14% using the formula of IRR on the range of cash received from the investment.

Internal rate of return (IRR)

IRR is the present value of the discount rate that has been set and regarding all the inflow of the project toward zero. It compares the opportunities of the investment if the IRR is over or below the acceptable rate of return that is selected (O'Hagan and Klatzer, 2018).

The IRR value that has been calculated from the investment appraisal of the Easy Jet has been assessed at 14%.

Profitability Index (PI)

The Profitability index reflects the relationship between the projects of the company with its future cash flow and the initial amount of investment. The calculation derives the ratio and the proper analysis can assess the viability of the project (Baum et al. 2021). This is also named the “profit investment ratio because it could help in the analysis of the profit of the project.

Discounted payback period

In this discounted investment appraisal method is when the initial investment amount of the investment flows back to the business b on the n basis of the time value of money. This determines the return investors can expect from the investment opportunity (Goldstein, 2019).

The payback period of the investment opportunity of Easyjet has been analyzed under the discounted method. The time the investment required to render the business with a positive amount against its cash flow, that is the difference between the cash inflow and cash outflow, has been determined after 4 years and before 5 years. The investment v NPV was at a negative value till their 4th year at -5431100 and in the 5th year, it generated a positive NPV of 3426250. The accurate representation of the Payback period of the investment has been assessed ast 4.6131 years.

Non-discounted payback period

In the payback period method of the non-discounted techniques, the time of compensating the overall initial cost of the investment is assessed (Bonomi Savignon et al. 2019). The duration the investment project takes to attain the desired break-even point is the payback period of the investment.

Accounting rate of return (ARR)

The ARR is the rate of return that could be expected from the investment based on its initial cost.

Conclusion

The assignment has highlighted the Investment appraisal techniques. The budgeting techniques have been discussed in the assignment with the address of the macro economical factors affecting the budgeting approaches adopted by the businesses. The budgeting approaches of traditional and modern budgeting techniques have been discussed in the assignment. The finical performance of EasyJet has been analyzed by the financial representation of ratios of 2018 and 2019. The financial performance of Easyjet has been compared with its competitor firm British Airways for the same period. The ratio analysis has helped in the conclusion the market position of EasyJet has been better compared to its competitor firm.

Reference list

Ahmed, F., Awais, I. and Kashif, M., 2018. Financial leverage and firms’ performance: Empirical evidence from KSE-100 Index. Etikonomi: Jurnal Ekonomi, 17(1), pp.45-56.

AlShamsi, S. and Nobanee, H., 2020. Financial Management of Climate Change: A Mini-Review. Available at SSRN 3538944.

Aziz, H. and Shah, N., 2021. Participatory budgeting: Models and approaches. In Pathways Between Social Science and Computational Social Science (pp. 215-236). Springer, Cham.

Baum, A.E., Crosby, N. and Devaney, S., 2021. Property investment appraisal. John Wiley & Sons.

Bonomi Savignon, A., Costumato, L. and Marchese, B., 2019. Performance budgeting in context: an analysis of Italian central administrations. Administrative Sciences, 9(4), p.79.

Campisi, D., Mancuso, P., Mastrodonato, S.L. and Morea, D., 2019. Efficiency assessment of knowledge intensive business services industry in Italy: Data envelopment analysis (DEA) and financial ratio analysis. Measuring Business Excellence, 23(4), pp.484-495.

Corporate.easyjet (2018), ANNUAL REPORT AND ACCOUNTS 2018. Avialable at: https://corporate.easyjet.com/~/media/Files/E/Easyjet/pdf/investors/results-centre/2018/2018-annual-report-and-accounts.pdf [Accessed on 1.11.22]

Corporate.easyjet (2019), ANNUAL REPORT AND ACCOUNTS 2019. Avialable at: https://corporate.easyjet.com/~/media/Files/E/Easyjet/pdf/investors/results-centre/2019/eas040-annual-report-2019-web.pdf [Accessed on 1.11.22]

Dance, M. and Imade, S., 2019. Financial ratio analysis in predicting financial conditions distress in indonesia stock exchange. Russian Journal of Agricultural and Socio-Economic Sciences, 86(2), pp.155-165.

Easyjet (2022), Homepage. Avialable at: https://www.easyjet.com/en [Accessed on 1.11.22]

Garbowski, M., Drobyazko, S., Matveeva, V., Kyiashko, O. and Dmytrovska, V., 2019. Financial accounting of E-business enterprises. Academy of Accounting and Financial Studies Journal, 23, pp.1-5.

Ghiyasi, M., 2018. Performance assessment and capital budgeting based on performance. Benchmarking: An International Journal.

Goldstein, L., 2019. College and university budgeting: A guide for academics and other stakeholders. National Association of College and University Business Officers.

Husain, T. and Sunardi, N., 2020. Firm's Value Prediction Based on Profitability Ratios and Dividend Policy. Finance & Economics Review, 2(2), pp.13-26.

Iairgroup (2019), Annual Report And Accounts 2019. Avialable at: https://www.iairgroup.com/~/media/Files/I/IAG/documents/British%20Airways%20Plc%20Annual%20Report%20and%20Accounts%202019.pdf [Accessed on 1.11.22]

Klatzer, E., Addabbo, T., Alarcon-García, G. and O’Hagan, A., 2018. Developments in practice: Methodologies and approaches to gender budgeting. In Gender Budgeting in Europe (pp. 109-133). Palgrave Macmillan, Cham.

LEN, V. and GLIVENKO, V., 2019. Accounting Policies and Its Components. Облiк i фiнанси, (2), pp.26-35.

Lutsyk, J., Diachenko, S., Kyrychenko, S., Kotsyuruba, V. and Tkach, I., 2020. Accounting policy of the government sector entity at the current stage of accounting systems development in accordance with international standards. VUZF review, 5(1), p.38.

Marotta, G., Krahnhof, P. and Au, C.D., 2022. A Critical Analysis of Budgeting Processes from the Pharmaceutical Industry and Beyond. Journal of Applied Finance & Banking, 12(3), pp.35-53.

Minetto, S., Rossetti, A. and Marinetti, S., 2018. Seasonal energy efficiency ratio for remote condensing units in commercial refrigeration systems. International Journal of Refrigeration, 85, pp.85-96.

Miransyah, G.G. and Dempo, S.R.S., 2021. Profitability Ratio Analysis at PT. Medikaloka Hermina, TBK. BINA BANGSA INTERNATIONAL JOURNAL OF BUSINESS AND MANAGEMENT, 1(1), pp.60-67.

O'Hagan, A. and Klatzer, E. eds., 2018. Gender budgeting in Europe: Developments and challenges. Springer.

Okolelova, E., Shibaeva, M. and Trukhina, N., 2018. Model of investment appraisal of high-rise construction with account of cost of land resources. In E3S Web of Conferences (Vol. 33, p. 03014). EDP Sciences.

Pavel, N., 2021. ACCOUNTING POLICIES AND PROFESSIONAL JUDGMENT APPLICATION OF IFRS 16" LEASING CONTRACTS". REVISTA ECONOMIA CONTEMPORANĂ, 6(2), pp.133-137.

Polzer, T., Nolte, I.M. and Seiwald, J., 2021. Gender budgeting in public financial management: a literature review and research agenda. International Review of Administrative Sciences, p.00208523211031796.

Simamora, R.A. and Hendarjatno, H., 2019. The effects of audit client tenure, audit lag, opinion shopping, liquidity ratio, and leverage to the going concern audit opinion. Asian Journal of Accounting Research, 4(1), pp.145-156.

Stanimirović, T. and Klun, M., 2021. Gender budgeting in Slovenia—approaches, achievements, and complexities. Public Money & Management, 41(7), pp.548-553.

Vierlboeck, M., Gövert, K., Trauer, J. and Lindemann, U., 2019, July. Budgeting for agile product development. In Proceedings of the Design Society: International Conference on Engineering Design (Vol. 1, No. 1, pp. 2169-2178). Cambridge University Press.

Wijnen, B.F., Lokkerbol, J., Boot, C., Havermans, B.M., van der Beek, A.J. and Smit, F., 2020. Implementing interventions to reduce work-related stress among health-care workers: An investment appraisal from the employer’s perspective. International Archives of Occupational and Environmental Health, 93(1), pp.123-132.

Wijnen, B.F., Lokkerbol, J., Boot, C., Havermans, B.M., van der Beek, A.J. and Smit, F., 2020. Implementing interventions to reduce work-related stress among health-care workers: An investment appraisal from the employer’s perspective. International Archives of Occupational and Environmental Health, 93(1), pp.123-132.

Zaytsev, A.A., Blizkyi, R.S., Rakhmeeva, I.I. and Dmitriev, N.D., 2021. Building a model for financial management of digital technologies in the areas of combinatorial effects. Economies, 9(2), p.52.

Bibliography:

Kengatharan, L. and Nurullah, M., 2018. Capital investment appraisal practices in the emerging market economy of Sri Lanka. Asian Journal of Business and Accounting, 11(2), pp.121-150.

Kipkirui, L.P. and Kimungunyi, S., 2022. EFFECT OF NET PRESENT VALUE INVESTMENT APPRAISAL PRACTICE ON FINANCIAL PERFORMANCE OF CEMENT MANUFACTURING FIRMS IN KENYA. International Research Journal of Economics and Finance, 4(2).

Konstantin, P. and Konstantin, M., 2018. Investment appraisal methods. In Power and energy systems engineering economics (pp. 39-64). Springer, Cham.

Lefley, F., 2018. Dispelling the Myth Around the Financial Appraisal of Capital Projects. IEEE Engineering Management Review, 46(1), pp.47-51.

Oesterreich, T.D. and Teuteberg, F., 2018. Looking at the big picture of IS investment appraisal through the lens of systems theory: A System Dynamics approach for understanding the economic impact of BIM. Computers in Industry, 99, pp.262-281.

Tan, C., 2022, March. Investment Decision Analysis Based on NPV, IRR, and the Fisher Separation Theorem. In 2022 7th International Conference on Financial Innovation and Economic Development (ICFIED 2022) (pp. 2680-2684). Atlantis Press.

Tang, S.L., The Difference Between IRR and NPV in Capital Investment Appraisals. In Construction in the 21st Century 12th International Conference (CITC 12) (p. 1).