- Introduction Of Summative Assessment Blog Assignment

- Junks Bonds and Impact of Macroeconomic Scenarios on Us Investors

- Macro-economic scenario in US

- Blog 2

- Green Bond, Surge in Green Bond Issuances and Its Impact on Sustainable Investing

- Reason for increase in bond issuance and its impact on sustainable investing

- Blog 3

- Fallen Angle Along with Case of Thames Water and Its Impact on Bondholder

- Case of Thames Water

- (B) Comment on Green Bonds: Option 4

- (C) Reflective Short

Introduction Of Summative Assessment Blog Assignment

Junks Bonds and Impact of Macroeconomic Scenarios on Us Investors

Junk bonds refer to debt instrument issued by the business organization that carries high risk of default than other bonds (Clarfelt, 2024). These bonds are given low credit rating which results in higher chances of default by issuer. Due to huge risk, investors are generally provided with an effective interest rate because of which it is known as high-yield bonds. Junk bond holders are unsure whether they will be able to get their principle amount and interest back which results in providing high interest so that large number of investors could be attracted.

Assignment deadlines piling up? Let New Assignment Help ease your burden with expert assignment help in UK tailored for student success.

Macro-economic scenario in US

Following are various factors through which macroeconomic scenarios of country could be identified:

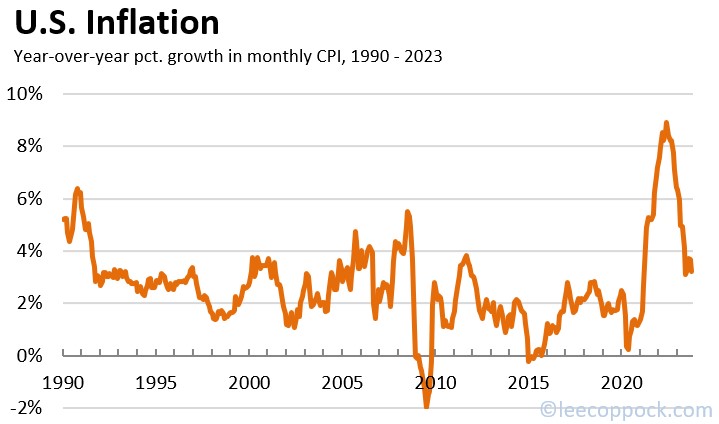

Inflation rate: In year 2024, inflation rate in US is 2.44% which is very high, due to rise in job vacancies to unemployment ratio (Inflation rate in US, 2024). High inflation rate has resulted in decreasing overall purchasing power of the individuals which further leads lower investment. This results into reducing demand for junk bonds as high inflation decreases the real return on fixed income investment such as Treasuries, bonds and CDs. Further, high inflation also results in lowering interest rate that result in reducing motivation of investors to invest towards high risky securities.

Unemployment: it has identified that there is 0.4% increase in unemployment rate in US as compare to year 2023 which amounted to 4.1% in September 2024 (Unemployment rate in US, 2023). Unemployment rate increases due to high rise in federal rate that result in reducing aggregate demand. High unemployment rate results in straining public finances, reducing purchasing power and creates situation of recession that results in decreasing investor’s motivation.

Economic growth: There is constant economic growth in US which amount to 1.9% increase in year 2022 and 2.5% in year 2023. US’s GDP has reached to 27.4 trillion dollar in current year which indicates increase in government spending, exports and fixed investment (GDP of US, 2024). High economic growth indicates the rising demand of product, high corporate growth and the presence of large number of the investors. Due to the continuous economic growth, organizations are ready to issue high yielding securities that result in attracting numerous investors.

Interest rate: In year of 2024, the United Stated Federal Reserve has reduced the interest rate by 0.5% with the aim of decreasing unemployment and inflation within the country (Interest rate in US, 2023). The lower interest rate on saving has resulted in reducing earning of individual that reduces their attraction towards investment. However, there is a rise in demand for the junk bonds as investors are aiming at buying securities which will provide high amount of interest.

Fiscal policy: Tax rates and government spending also have huge impact on overall investor’s decisions. Average tax rate in US is very high which account to 14.9% in year 2023. This results in reducing income and purchasing power of individual leads to low investment (US’s fiscal policy, 2024).

Blog 2

Green Bond, Surge in Green Bond Issuances and Its Impact on Sustainable Investing

In the current times, individual’s emphasis over protecting and preserving natural resources has increased that result into generating the concept of green bonds. It is the type of debt security which is issued to finance environmental project by the corporation’s (Harris, 2024). The funds raised by issuing green bonds are generally used in the projects that are carried out by renewable energy, clean transportation, waste management and energy efficient system. Green Bond principles are established by Internal Capital market association (ICMA) which needs to follow by company for issuing such bonds. This includes clearly defining sustainability goals, transparency regarding use of funds and investment should create adequate impact on environment.

Reason for increase in bond issuance and its impact on sustainable investing

In the first quarter of 2024, it has been identified that green bond issuance surge has reached 273 billion dollar (Green bond surge in US, 2024). This strategy has resulted in increasing investor’s interest in environment, social and governance project. Due to the increasing demand for the Green bond, a company has shifted towards financing low carbon project through the issue of such bond. In US, companies started issuing Green bond with the aim of attracting foreign investors and promoting sustainable development within country. Further, these bonds are generally issued at discount and provided high interest rate that result in increasing sustainable investing. Following are major causes behind surge in Green bond issuances:

High interest rate: Companies issuing Green bond provide high interest rate as to showcase its concern towards protecting environment that results in creating effective reputation and goodwill within industry (Maltais and Nykvist, 2020). Further, green bonds are issued at discounts which make it attractive for the investor’s results that result into enhancement of sustainable investment within the country.

Greenium erosion: The green bond market has surged due to end of Greenium bond as it impact on the prices of conventional bonds. Greenium erosion has resulted in reducing cons of the green bonds that makes it’s an attractive fixed income securities for the investors.

ESG factor: Due to the high focus over environment, government and social factors, it caused a surge in Green bond issuance. Investors are attracted towards firm that are promoting transparency in sustainable project and focusing over protecting natural resources. For example: constellation energy is the leading firm which is leveraging green bond for nuclear energy project.

Tax exemption: For promoting sustainability within country government has provided tax exemption benefits to the investors (Piñeiro-Chousa et al, 2021). This results into increasing return for the investors that leads to higher demand for Green bond resulting in bond issuance surge.

The green bond surge has marked a prominent shift in the preference of the investors towards sustainable investing. The debt security provided various financial benefits to investors due to high interest, tax exemption policy that results in increasing sustainable investing within the country.

Blog 3

Fallen Angle Along with Case of Thames Water and Its Impact on Bondholder

Fallen angle implies the bond that was initially provided investment grade rating but frequently it reduces to junk bond status (Smith, Plimmer and Cumbo, 2024). This condition has arisen due to deteriorating profitability and financial position of the issuer. The situation of fallen angle is caused due to the reduction in revenue that leads to incapability of issuer in paying out interest. Further, this situation got worse when the organization secure more debt for fulfilling profitability gap (Fallen Angle in Bond, 2024). These types of securities are mainly purchased by the contrarian investors which prefer going opposite to the market trend. Investors are influenced towards this security as with the decline in bond’s prices, issuer provides higher rate of interest which increase investors’ satisfaction level.

Case of Thames Water

Thames water is the private utility organization that is involved towards providing water supply and treating waste water in most part of Thames valley, Greater London, Gloucestershire and surrey. The firm was fined 3.3m Pound in the year of 2023 due to releasing undiluted sewerage and waste water into river of Sussex and Mole resulting in killing more than 1400 fishes (Case of Thames water, 2023). Further, this has leads to building toxic algae that are fatal for swimmers and the animals. Along with this, Thames water was also aiming at rising customer’s bill by 40% in the upcoming years. This has been done with the view of excessive population growth and high usage of water.

Impact of the case on bond holder

Following are various impact of the particular case on the bond holder of the company:

- Thames water was recognized as thirst largest corporation of UK to issue green bonds. Organisation has obtained a debt funding of over 15 billion pound among which 3 million pound has raised by issuing green bond. However, inclusion in unethical activities has resulted in increasing risk for the green bond holder and reduces the trust and confidence of others towards green bonds (Acharya et al, 2021). This has also created obstacles in the continuous development of green bond market within UK.

- Due to organization’s aim of increasing customer’s bills, firm will face difficulty in attracting investors. According to Ofwat, the decision of Thames water is not adequate that will result in creating financial crisis. This has creates an issue for bondholder as financial crisis will results in creating issue for organization to pay off its interest obligation.

- Along with this, investor refuses to inject 500 billion into business due to unethical practices and strategies of the company. Investors were also influenced by the statement of Ofwat that results in creating issue in carrying out firm’s operations (Acharya and Steffen 2020). This has result in company’s failure in paying interest on 1.4 billion debt results in reducing trust and confidence of bondholder.

Prior to this case, Bond of Thames water were highly secured due to effective financial position of the company. Current scenario of Thames water has resulted in developing situation of fallen angles due to decreasing investment rating of the business entity.

(B) Comment on Green Bonds: Option 4

Thank you for sharing blog.......you have provided a good explanation regarding the various benefits and drawbacks of issuing green bonds.

There is an increasing demand for green bond within UK and companies have shifted towards raising fund by issuing this bond. However, companies are not issuing green bond with the aim of promoting sustainability rather than placing emphasis on earning the huge profits. From the case study of Finnish pulp and Paper Company in Finland, it has been depicted that green bond are creating social and environmental impact within the country. The company was unable to provide adequate evidence related to their sustainable activities rather the funds was used to finance daily activities of the business entity. This leads to losing investors trust towards the organization which in turn indicates the ineffective growth potential of green bond within the country. In my opinion, Green washing is the major issue which will result into reduction in the growth of green bond and thereby decreases the trust as well as confidence of investors towards such bond. By linking to your question, green bond will not help in reducing climatic impact rather it is used for influencing investors and fulfilling firm’s financing need. In my opinion, there is no point of issuing green bond if the firm is unable to create any positive impact on the environment.

(C) Reflective Short

Gibbs reflective model will be used to share my learning process while writing three blog. This assignment has helped me in developing knowledge regarding various different types of bonds prevailing in the market. My knowledge regarding the structure and format of the blog has also enhanced through this assignment. I was able to understand the current macroeconomic environment of US. I have also used my researching skill through which information regarding the topics has been collected. This helps me in understanding how to evaluate different sources based on which most accurate and reliable information could be gathered. This report also help in determining manner through which blog should be written and also able to identify information that should be covered within a Blog. This has also developed my analytical skills such as critical thinking and problem solving which will help me in effectively carrying out task in future. Due to effective critical thinking skill, I was able to determine impact of all the bonds on the decision of the investors. I have further determining all the negative consequences of firm’s decision on the perception of investors. While writing blog, I faced issues in timely completing the blog, to overcome the issue I have used my time management skills. Under this, I have allotted an adequate time to each blog so that most accurate and effective blogs could be written within an allocated time. I have identified various reasons due to which investors are attracted towards junk bonds. Along with this, I have also learned regarding the case study of Thames water and able to understand reason behind occurrence of fallen angle situation within the organization. This learning will help me in effective evaluating firm’s financial position before investing in bonds. This knowledge will assist me in effective managing my portfolio and support in mitigating investment risk in future.

REFERENCES

Books and Journals

- Acharya, V. V., & Steffen, S. (2020). The risk of being a fallen angel and the corporate dash for cash in the midst of COVID. The Review of Corporate Finance Studies, 9(3), 430-471.

- Acharya, V. V., Banerjee, R., Crosignani, M., Eisert, T., & Spigt, R. (2021). Exorbitant Privilege? The Bond Market Subsidy of Prospective Fallen Angels. NBER Working Paper, 29777.

- Clarfelt, H. (2024) Investors shun riskier junk bonds as bankruptcy filings jump.

- Harris, L. (2024) Green bond issuance surges as investors hunt for yield.

- Maltais, A. & Nykvist, B. (2020). Understanding the role of green bonds in advancing sustainability. Journal of sustainable finance & investment, pp.1-20.

- Piñeiro-Chousa, J., López-Cabarcos, M.Á., Caby, J. & Šević. (2021). The influence of investor sentiment on the green bond market. Technological Forecasting and Social Change, 162, p.120351.

- Smith, R. Plimmer, G. and Cumbo, J. (2024) Thames Water's credit rating slashed to “junk'.

Online

- Case of Thames water. 2023. Online. Available through: < https://www.bbc.com/news/articles/cx0vk2d4wvgo#:~:text=The%20number%20of%20hours%20in,analysed%20by%20London's%20City%20Hall.>

- Fallen Angle in Bond.2024. Online. Available through: < https://www.ft.com/content/7d79cf75-8f67-4f27-a6a1-507640b77f7e>

- GDP of US. 2024. Online. Available through: < https://www.bea.gov/data/gdp/gross-domestic-product>

- Green bond surge in US. 2024. Online. Available through: < https://www.climatebonds.net/2024/06/record-start-year-sustainable-debt#:~:text=7bn%20of%20aligned%20green%2C%20social,the%20USD193bn%20from%20Q4%202023.>

- Inflation rate in US. 2024. Online. Available through: < https://www.statista.com/statistics/273418/unadjusted-monthly-inflation-rate-in-the-us/#:~:text=The%20annual%20inflation%20rate%20in,available%20funds%20to%20make%20purchases.>

- Interest rate in US. 2023.Online. Available through: < https://www.rnbgujarat.org/us-interest-rate-changes/#:~:text=As%20a%20result%2C%20the%20bank,highest%20level%20since%20January%202001. >

- Unemployment rate in US. 2023. Online. Available through: < https://www.bls.gov/news.release/pdf/empsit.pdf>

- US’s fiscal policy. 2024. Online. Available through: < https://fiscaldata.treasury.gov/americas-finance-guide/federal-spending/#:~:text=The%20U.S.%20government%20has%20spent,people%20of%20the%20United%20States.&text=Fiscal%20year%2Dto%2Ddate%20(,Treasury%20Statement%20(MTS)%20dataset.>

Overwhelmed by coursework? Let New Assignment Help ease your burden with expert Assignment Help in UK tailored for student success.

Assignment deadlines piling up?