- Introduction Of The Managing Finance In The Health And Social Care Sector Assignment

- Task 1: Preparatory Report

- Importance of accounting and finance management in the context of a Health and Social Care organisation

- Utilization of Financial software within the accounting functions of organisations

- Explaining key financial ratios used by Health and Social Care organisations

- Differentiate between long and short-term business finance needs of Health and Social Care organisations

- Explain the benefits and limitations of various sources of finance available to an organisation

- Evaluate the process of budgetary control and revenue management in a Health and Social Care organisation

- Task 2: Business report

- Describing organizational budgets in the given health and social care

- Evaluation of capital expenditures and investment projects using different investment appraisal techniques

- Recommendations for financial management

Introduction Of The Managing Finance In The Health And Social Care Sector Assignment

Task 1: Preparatory Report

Financial management tools are important in tracking the overall transactions and the investment decisions that are made by the company. This helps in creating an appropriate budget plan that can manage the cash flow. The various financial statements that are used by the organisations include the “income sheet, balance sheet and the annual report summary”. The overall report sheds light on the importance of financial management in enhancing the decision-making strategy and market revenue of the company.

Trust New Assignment Help for unparalleled Assignment Help UK. With our attention to detail and commitment to excellence, we guarantee academic success.

Importance of accounting and finance management in the context of a Health and Social Care organisation

Financial report preparation is important for the company to enhance their overall decision-making process and budget-plan ratios. The healthcare organisations with the best financial analysis can be useful in providing the best healthcare to patients. A thorough audit of the healthcare organisations can benefit the company to improve its financial health. However, for the effective continuation of the overall services, there is a requirement for a suitable financial plan that can directly add value to the financial performance of the sector (Ameliawati and Setiyani, 20180. Healthcare leaders must have the presence of leadership skills that can help in providing trained staff to social and healthcare organisations.

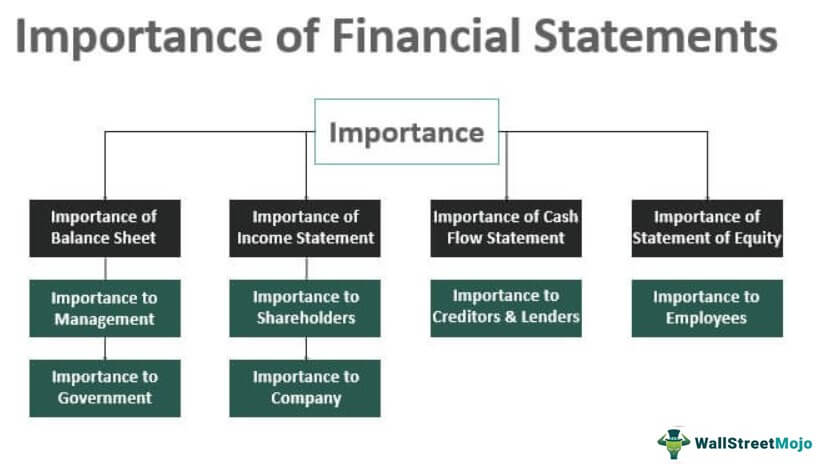

Figure 1: Importance of the accounting process within the healthcare sectors

Based on the study aspects it can be critically opined that there are different importance of finance and account management. The importance includes proper planning based on the company guidelines. Improvement in the overall decision-making process can be overall improved by the incorporation of the setting up of appropriate budget planning. However, treatment facilities within the organisation can be improved by incorporating suitable financial decisions that can overall help in the effective treatment procedure.

Utilization of Financial software within the accounting functions of organisations

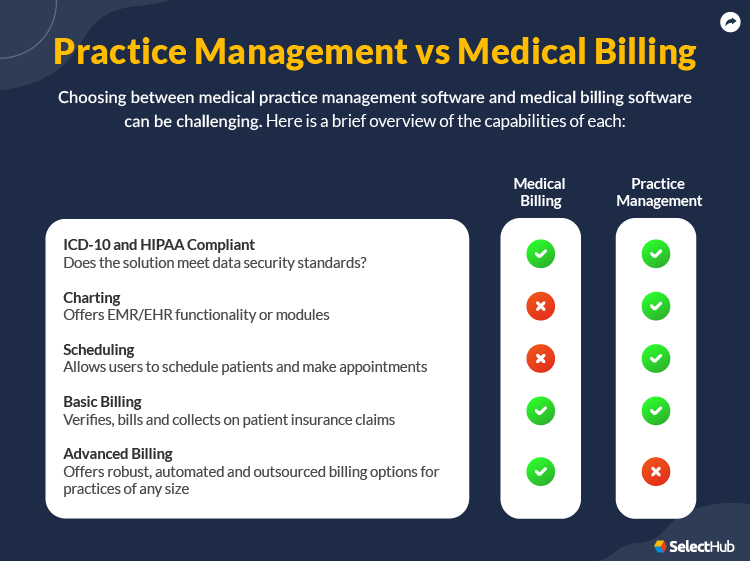

Healthcare organisations must think of various administrative methods that can improve the ways of treatment procedures among patients. The overall revenue cycle of the organisation can be maintained with the help of the “Healthcare financial software” (Putra, 2019). The first importance of this software is to automate the overall billing process within the healthcare organisation. This process reduces the workload on the clerical staff that are working within the organisation.

Figure 2: Importance of Financial software in the Healthcare sectors

However, the second importance of this software is to make the overall administrative process efficient and thus improve the operational management process. Thirdly, the incorporation of financial software within the healthcare organisation can help in reducing billing errors and thus make the financial report more effective. The main task of this software is to keep a record of the patient collections, data and treatment regime (Hopwood, 2019). Furthermore, it can be stated that accounting software prepares the overall tax obligations and thus maintains the cash flow rate within the organisation. Software such as “Aqilla’s bid” is mainly used for maintaining financial reports within the healthcare sectors of the UK.

Explaining key financial ratios used by Health and Social Care organisations

The healthcare sector is depicted as one of the largest markets that directly deals with the safety of the citizens of the country. The key financial ratios include the “liquidity ratio, profitability ratio, ROCE ratio and leverage ratios”. This ratio allows an organisation to showcase the fact that efficient cash flow reflects on the financial survival rate of the company (Baskerville and Grossi, 2019). The “cash flow” of the depicted company can be calculated by dividing the overall operational flow related to the company. The positive value of this financial ratio helps in depicting the fact that the organisation has a strong stage in obtaining more financial capital.

The “profitability ratio” depicts the company's sales profit or loss based on the current market scenario. This allows for keeping an eye on the company balance sheets and the stakeholder equity to determine the competitiveness of the company. Financial ratios help in depicting the fact that the performance level of the company can be enhanced by a proper decision-making process. The positive rate of the “profitability ratio” depicts that the company can easily attract a strong range of investors and thus grows its business in the competitive market. The “ROCE ratio” depicts the ways a company can increase their overall market revenue by using the company assets.

Various studies depict the fact that a higher rate of the above-depicted financial ratio can be useful in generating more assets for the company (Smith, 2022). However, the other financial ratio depicted as the “leverage ratio” illustrates the amount of debt that the organisation is carrying with respect to the competitive market. The importance of the ratio is to visualise the performance level of the company in comparison to the other sectors in the UK. Moreover, the health of the overall healthcare sector can be enhanced by planning an appropriate financial statement.

Differentiate between long and short-term business finance needs of Health and Social Care organisations

Long-term financing mainly constitutes internal and external strategic investments that directly add value to the company's profitability. However, short-term financing depicts the daily operational needs that are important for the company to enhance their market. The various differentiating factors that differentiate long-term finance from short-term finance include the loan amount (Gałecka and Cyburt, 2019). In case of the short-term financing, the loan amount is less and thus the repayment tenure is also less compared to long-term financing.

The rate based on long-term financing is illustrated as the “fixed rate” and the rate based on short-term financing can be illustrated as having the “floating rate”. However, short-term financing is mainly supplied by the Bank and on the other hand; the finance in case of long-term financing is supplied by the “investors” (Moll and Yigitbasioglu, 2019). The “long-term financing” can be done with the help of the “equity financial, corporate bond and the capital notes”. However, “short-time financing” can be done with the help of various financial instruments such as “Asset-backed commercial paper” that allows the keeping of a record of the overall documentary process.

Explain the benefits and limitations of various sources of finance available to an organisation

Finance is important for a healthcare organisation to expand the overall development and the operational process. The healthcare sector needs to take care of its financial reporting as it can help them to manage its overall resources properly. As per the overall report, it can be demonstrated that the Anchor organisation based on the current market scenario is operating 113 residential homes for old people. The company however managed to use their financial sources properly and make an overall operating profit of “47.33 million pounds” in 2022 (Anchorgroupservices.co.uk, 2019). As per the view of various studies, it can be depicted that, the various sources of finance include the “owner’s capital, retained profits, selling assets, family and friends, bank loan, overdraft, venture capitalists, share issues, leasing and trade-credit”. The advantages of the “owner's capital” include that this does not require any presence of borrowing money and no interest is required to be paid.

Various studies depict that “selling assets” have the property to raise overall money from unused equipment. On the other hand, the disadvantage realted to the above-mentioned finance source is that the full amount of the market revenue cannot be received with the help of this financial resourcing. The other source includes the “bank loan” that helps in getting easy access to money. However, on the other hand, the disadvantage related to the above financial source is that they have the presence of less interest (Gofwan, 2022). “Overdraft” has the presence of high emergency passages that can allow in getting quick access to money. On the other hand, the disadvantage related to it is that they have the presence of a high rate of interest.

Evaluate the process of budgetary control and revenue management in a Health and Social Care organisation

The overall budget plan of the healthcare organisation can be managed with the help of the “Budgetary control process”. This process helps in monitoring the various financial ratios and thus put a positive impact on the profitability ratio of the company. The process of budgetary control first includes the preparation of the monitor budgets. Secondly, cost overruns are the next process that is required to be done in the next step (Hosaka, 2019). Thirdly, the utility of financial reporting can be enhanced with the help of this process. Furthermore, the daily patient report and the operations in the healthcare sectors can be managed with the help of this “Budgetary control process”.

The “Revenue cycle management (RCM)” is the cycle that demonstrates the process for which the hospital management is paid. This property starts by dealing with the patient scheduling process to the payment process. This process depicts the fact that the patient is charged for the services that are provided to them by the hospitals.

Explain the rules of double-entry book-keeping and how it is used to maintain financial records

The main rule related to “doubt-entry book keeping” is that it helps in recording the overall transactions on the basis of the credits and the debits made. However, the second rule includes that some of the credits made are always equal to that of the debit made.

The above-mentioned process records the overall credits and the debits made. This process keeps an account of the overall accounting process and thus ensures the accuracy of the financial statements that are prepared by the organisation. This process also detects the errors that are made in the financial statement.

Conclusion

Thus, it can be concluded from the overall report that, the perfect management of the various financial ratios within the organisation can be useful in over viewing the cash flow and the operating profit ratio. The advantage related to the “retained profit” is that it is the easiest way to get access to the money. However, the disadvantage related to the above financial source is that if the money is gone for some time then it's totally gone.

Task 2: Business report

Financial management is the most important aspect that needs to be managed in the best possible ways for organisational development. It is more important to manage the financial aspects when it is an aspect of providing housing and care support for old age. A better and well-shaped financial stability should be prepared for any time access. Here the organisation named Anchor has to be more developed in terms of financial management so that better services can be assured for their consumers.

Describing organizational budgets in the given health and social care

The company needs to be informed about their organisational budgets so that it can maintain its competitive nature based on the current market scenario. The overall organisational budget depending on the turnover ratio is depicted to be 526.2 million Euros which mainly is seem to decrease after the emergence of the COVID-19 pandemic. The lack of appropriate decision-making procedures directly affected the overall financial statement of the Anchor Company (Moll and Yigitbasioglu, 2019). As per the financial analysis, it can be depicted that, the net care properties increased in 2022 by 5%. The financial ratios that have been analysed in the overall report include the “liquidity ratio, profitability ratio, ROCE ratio and leverage ratios”. The proper analysis of the financial ratios can be useful in depicting the organisational budget based on the market scenario.

From the analysis of the financial statements, it can be depicted that, the “profitability ratio of the company” increased in 2022 after the incorporation of the financial software. This opined that though the sales of the company decreased by some amount and it helped in enhancing the overall market profitability. The “profitability ratio” came to 35594.18 in 2022 after keeping an eye on the financial errors (Amazonaws.com, 2022). However, the “activity ROCE ratio” in 2022 seemed to decrease based on the market scenario. This depicted the fact that the current liabilities in 2022 came as 1391.3 and the value seems to increase compared to 2021. The “activity ratio” came as “-5.39 million euro” based on the Anchor company market scenario.

Further analysis of the financial ratios depicted the fact that the “liquidity ratio” seemed to increase in 2022 after the emergence of the appropriate budget planning software. Moreover, the value of the “liquidity ratio” came to “0.136” in 2022 and the ratio came to “0.088’ in 2021. Moreover, the liabilities of the company were seen to enhance in 2022 after the incorporation of the decision-making strategies within the organisation. The “leverage ratio” depicts the fact that debt rate increased in 2022 compared to the debt rate of 2021. The reason for the increase in the debt ratio was due to the fact that the company built various financial strategies that directly add benefit to the market revenue. Based on the analysis of the financial ratios it can be depicted that this strategy plays an important role in the budget planning of the health and socialcare organisation.

Evaluation of capital expenditures and investment projects using different investment appraisal techniques

It has been seen that many companies and service providers from different organisational backgrounds have managed their financial stability in the best possible ways (Xudoyberdiyeva, 2019). Each and every organisation or mass service provider has to be sure about the financial outgoing and the income also so that ideas can be developed on financial management.

Here the organisation Anchor has served better services all over the UK that has ensured a better life opportunity for the old aged people in the country. However, there is the question of managing and gathering financial stability from the business that they provide. In today's world, it has been seen that there is no time to evaluate the health and needs of old aged people (Boisjoly et al. 2020). In terms of humanity, there are many things that can be utilised to bring them back to a peaceful and tension-free life. In this context, Anchor has the ability to provide them with the best possible support, however, providing huge support for old people with proper housing and care.

Here comes the financial management that needs to be managed and fulfilled by the organisation in terms of getting more developed. The very annual revenues of the organisation have shared that in the year 2019, the organisation accumulated over £526.4 million which is quite a large amount that needs to be managed (Campos and Reich, 2019). The role of proper investments in the right places is needed to be applied to have better returns from the business. In the year 2020, the organisation has £522.2 million from the respective year. In the year 2021, the organisation has gathered over £528.2 million from the business and that is also needed to be utilised in the proper way of management so that the developments towards further business can be achieved. In the year 2022, £526.2 million has been generated from their service all over the country UK.

Investments can be proven positive for the organisation as they have to expand nature in their services. Here the investments are needed to be utilised and managed in such a way that the chances of gathering profits from the business can be generated. The above-discussed financial accumulation of the organisation has supported their services to get more developed over time.

On the other hand, it can be said that the organisation can take decisions on the basis of financial developments with the help of investing in proper areas of business (Haldane et al. 2021). Investments such as Growth investing can help the organisation to get more developed in terms of financial development. There are other investment options that can be used to bring developments or to bring growth in the financial aspects of the organisation. However, financial developers have to choose the right and effective investments so that the financial developments can be accessed. Here the growth investment can be chosen. Here, an organisation or company needs to be chosen in which the organisation wants to invest (Khatoon, 2020). In this context, the right companies need to be selected so that continuous growth can be observed. Evaluating the collected data it has been accumulated that the profitability of the organisation is quite lower in the year 2020. Another data related to the aspect of activity ratio has also demonstrated the EBIT percentages, Total assets and current liabilities percentages are also evaluated from where the lower percentages are noticed the most that need to be developed by the time to have better business profits from their services.

Recommendations for financial management

There can be recommendations that can be indicated for the further development of the services that the organisation provides.

Recommendation 1: Financial evaluation

The organisation should be aware of its financial accumulation and management, which can bring clarity to the expenses that the organisation does. It is important for the business developers of the organisation to be well-managed with financial management. It needs to be evaluated with the expenses that the organisation has implemented in their services.

Recommendation 2: Investments in proper areas

It has been mentioned above that, investments are capable to make the organisation more prone to have profits (Yip et al. 2019). The more the investments can be accessed the more the financial stability of the organisation can get developed. Helping other companies which have better futures can serve the organisation with future profits. Interest in the investments or the equity shares of the organisation has the ability to bring strong support from other business companies.

Recommendation 3: Develop services

It has been seen that the organisation has served better services for their consumers however their services can be more developed. The old age care and housing services can be developed more to expand their services and connect more consumers. Here it can be said that the services can be developed for the consumers the more the numbers of consumers can be increased. It has been seen that there are people in old age that has multiple kinds of health issues (Agyabeng et al. 2020). In this context, there should be better interventions that can help the patients to get recovered from the illness. Getting developed with better features in the service has the ability to bring better and positive changes in the business.

Anchor has constructed a positive and professional image on the level of the services that they provide for its consumers. Here the organisation has the chance to get more developed by the time by providing more efficient and better services for their consumers. In the country of the UK, there is a need for old age care and housing as most of the family members are out all the time for job purposes (Mosteanu and Faccia, 2020). The very safety and care for older parents are needed to be managed in the best possible ways so that their health and safety can be covered with positivity. It can be seen that individuals can have health issues also that need to be treated to be their health back for the individuals. In this context investments behind the health interventions can bring more developments for the organisation in terms of getting more expanded with their services.

Conclusion

It can be concluded from the above discussion that, the organisation Anchor has multiple scopes that can be used to bring financial developments. Here the organisation can invest in the growing companies to have better returns from the field. On the other hand, they can also bring more consumers into the business and get more expanded over time.

Reference list

- Agyabeng-Mensah, Y., Afum, E. and Ahenkorah, E., 2020. Exploring financial performance and green logistics management practices: examining the mediating influences of market, environmental and social performances. Journal of cleaner production, 258, p.120613.

- Amazonaws.com 2022, Annual Report & Financial Statements 2022 Available at: https://anchorv3dev.s3.eu-west-2.amazonaws.com/documents-pdfs/Anchor%20Annual%20Report%20%26%20Financial%20Statements%202022.pdf [Accessed at: 27-01-2.23]

- Ameliawati, M. and Setiyani, R., 2018. The influence of financial attitude, financial socialization, and financial experience to financial management behavior with financial literacy as the mediation variable. KnE Social Sciences, pp.811-832.

- Anchorgroupservices.co.uk 2019, Thirty years of evolution in the FM landscape. Your industry - Our services Available at: https://www.anchorgroupservices.co.uk/ [Accessed at: 27-01-2.23]

- Awaysheh, A., Heron, R.A., Perry, T. and Wilson, J.I., 2020. On the relation between corporate social responsibility and financial performance. Strategic Management Journal, 41(6), pp.965-987.

- Baskerville, R. and Grossi, G., 2019. Glocalization of accounting standards: Observations on neo-institutionalism of IPSAS. Public Money & Management, 39(2), pp.95-103.

- Boisjoly, R.P., Conine Jr, T.E. and McDonald IV, M.B., 2020. Working capital management: Financial and valuation impacts. Journal of Business Research, 108, pp.1-8.

- Brooks, C. and Oikonomou, I., 2018. The effects of environmental, social and governance disclosures and performance on firm value: A review of the literature in accounting and finance. The British Accounting Review, 50(1), pp.1-15.

- Campos, P.A. and Reich, M.R., 2019. Political analysis for health policy implementation. Health Systems & Reform, 5(3), pp.224-235.

- Gałecka, A. and Cyburt, A., 2019. Financial liquidity management in local government units of the eastern poland macroregion. Roczniki (Annals), 2019(1230-2020-798).

- Gofwan, H., 2022. Effect of accounting information system on financial performance of firms: A review of literature. DEPARTMENT OF ACCOUNTING (BINGHAM UNIVERSITY)-2nd Departmental Seminar Series with the Theme–History of Accounting Thoughts: A Methodological Approach. Vol. 2, No. 1.

- Haldane, V., De Foo, C., Abdalla, S.M., Jung, A.S., Tan, M., Wu, S., Chua, A., Verma, M., Shrestha, P., Singh, S. and Perez, T., 2021. Health systems resilience in managing the COVID-19 pandemic: lessons from 28 countries. Nature Medicine, 27(6), pp.964-980.

- Hopwood, A.G., 2019. Accounting and organisation change. In Management Control Theory (pp. 357-368). Routledge.

- Hosaka, T., 2019. Bankruptcy prediction using imaged financial ratios and convolutional neural networks. Expert systems with applications, 117, pp.287-299.

- Khatoon, A., 2020. A blockchain-based smart contract system for healthcare management. Electronics, 9(1), p.94.

- Li, H., Dai, J., Gershberg, T. and Vasarhelyi, M.A., 2018. Understanding usage and value of audit analytics for internal auditors: An organizational approach. International Journal of Accounting Information Systems, 28, pp.59-76.

- Moll, J. and Yigitbasioglu, O., 2019. The role of internet-related technologies in shaping the work of accountants: New directions for accounting research. The British accounting review, 51(6), p.100833.

- Mosteanu, N.R. and Faccia, A., 2020. Digital systems and new challenges of financial management–FinTech, XBRL, blockchain and cryptocurrencies. Quality-Access to Success Journal, 21(174), pp.159-166.

- Olafsson, A. and Pagel, M., 2018. The liquid hand-to-mouth: Evidence from personal finance management software. The Review of Financial Studies, 31(11), pp.4398-4446.

- Putra, Y.M., 2019. Analysis of factors affecting the interests of SMEs using accounting applications. Journal of Economics and Business, 2(3).

- Rikhardsson, P. and Yigitbasioglu, O., 2018. Business intelligence & analytics in management accounting research: Status and future focus. International Journal of Accounting Information Systems, 29, pp.37-58.

- Smith, M., 2022. Research methods in accounting. Research Methods in Accounting, pp.1-100.

- Xudoyberdiyeva, D.A., 2019. MANAGEMENT OF THE SERVICES SECTOR AND ITS CLASSIFICATION. Theoretical & Applied Science, (10), pp.656-658.

- Yip, W., Fu, H., Chen, A.T., Zhai, T., Jian, W., Xu, R., Pan, J., Hu, M., Zhou, Z., Chen, Q. and Mao, W., 2019. 10 years of health-care reform in China: progress and gaps in universal health coverage. The Lancet, 394(10204), pp.1192-1204.