MGT 603 System Thinking Assignment Sample

Introduction

System thinking is one of the ideas that are widely used by the business experts to solve the modern day’s business challenges related to their day-to-day operations. It facilitates managers with a plethora of tools to figure out the issues and solutions simultaneously. In this report, a discussion on the issues related to Commonwealth Bank Australia are outlined with the help of CATWOE tool and Rich Picture. Based on their consequences for the organisation, some recommendations are provided.

Problem Analysis

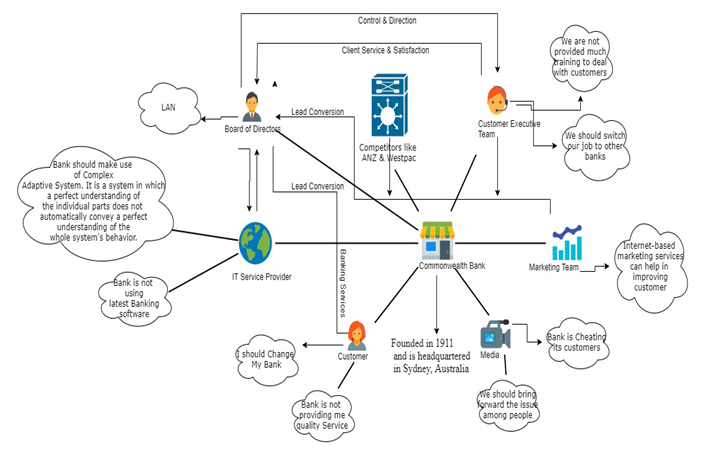

The Commonwealth Bank is one of the largest Multinational banks of Australia that was established in the year 1911 and is headquartered in Sydney, Australia. The bank has over 1100 branches and more than 4300 ATMs all around the world.

The issue that the organisation is facing is related to poor customer service that is resulting in customer dispersion. The loyal customers are not satisfied with the quality of services provided by the bank since last few years. They are moving away from the bank and opening their accounts in the rival banks. The issues are long waiting time for reaching the customer support executives (Getele, & Jean, 2018). Insufficient staff at the customer help windows due to which the issues are taking more time to resolve. All these challenges are piling up to force customer to close their accounts from the Commonwealth bank. As the consequence of these issues, the reputation of the bank is getting damaged. People are not trusting it to keep their money in the account. As a result of which, the target leads may not get converted (Kashif, et. al 2015). Also, the employees are not happy due to overburden of work due to shortage of manpower. This is increasing the employee turnover rate.

System Thinking

From the complete problem analysis of the Commonwealth Bank, it is quite understood that reducing quality of customer service is the prime issue for reducing customer base. Also, there are secondary impact too, such as damaged reputation and rising employee turnover that are required to be considered as well. System thinking tools, such as CATWOE and Rich Picture that can provide a better insight into likely consequences of the aforementioned issues (Peters, 2014). These are used below:-

Rich Picture

The Commonwealth Bank is one of the oldest banks of Australia and it has numerous stakeholders. Any issue affecting the bank’s operations would have severe impact on the bank’s operations and profitability. Ultimately, the stakeholders would also have some impact due to poor functioning of the bank. The main stakeholders of the company comprise both internal and external stakeholders. These include customers, employees, Reserve Bank of Australia, Service providers, board of directors, and marketing team (Elabore, 2014). With the help of the Rich Picture Diagram, one can be able to highlight the issue and likely concerns of each stakeholders in a better way (SSWM, 2019). It is shown below:-

CATWOE’s Root Definition Report

The Commonwealth Bank requires to understand the challenges affecting its business reputation and profitability. The CATWOE is the best tool for doing so. The CATWOE is one such device that would help with getting knowledge into the difficulties and their conceivable results on the stakeholders (Terra&Passador, 2018).

Customers: The primary customers of the bank consist of private and government-run businesses and common people. In addition to this, the IT and other technology providers can also be considered as the customers of the bank. These customers may change their preference and switch to other banks if they are not fully satisfied (Kashif, et. al 2015). The bank is required to fulfil their demands as earliest. The company may lose its market share as well if the issues are not resolved at the earliest.

Actors:As all the decisions are made by the senior management of the bank that consists of the CEO, the Board of Directors, and some senior executives. Therefore, they are to be considered as the primary actors of the banks (Gorgidze, 2012). It is essential for the smooth functioning of the bank that every actor is aware of the future plans of the bank.

Transformation Process:In order to transform the market strategy and strategies to attract customers, the Bank should work on increasing the services and provide high interest to its customers.

Worldview:If these issues are not resolved on time, then the bank’s may lose its revenue sources i.e., loyal customers. Also, the reputation of the bank may get damaged. People may not trustit. As a result of which, the target leads may not get converted. Also, the employees are not happy due to overburden of work due to shortage of manpower (Berman, 2015).

Owners:The CEO, the board of directors, and employees working in the Commonwealth Bank can be called the primary owners of the bank and the impact of the challenges would be high on them. For instance, poor customer satisfaction may affect the reputation of the bank. This may cause employees to leave the bank and join other banks.

Environment:The main constraint is lack of skilled employees and demotivated workers (Shukla, 2014). The Australian Securities Exchange has certain rules and guidelines under which the bank has to operate. Also, limited budget is the primary constraint hindering the customer service domain.

Recommendations& Conclusion

From the above system thinking analysis, the issues are pretty much clear and their likely impacts are understood. Here are some recommendations for the commonwealth bank to work on its customer service domain:-

It should work to maintain consistency across every touch point. It should focus on providing Omni-channel experience to the customers. In order to curb the competition, the Commonwealth Bank is required to provide 24/7 access to different banking facilities across all the channels. Customer should be made well aware about the latest schemes bank has launched and educate them to invest in it (Kashif, et. al 2015). This can be done by making use of latest technology and software. It should open customer service centres in public areas, such as Malls, recreational parks, local market, etc., to address all queries of the customers (Getele, & Jean, 2018).

It is also advised to the bank to educate its customers instead of just acting as lender. Try to build positive relationships with customers, especially small businesses. They are require to educate them to invest their money, strategic planning, and bookkeeping (Getele, & Jean, 2018). For that purpose, the bank can also embrace latest technology, such as video calling service, cloud computing, mobile-based investment portals, and providing biometric security to their accounts. All this would improve customer service and build long-term relationship with customers.

References

Berman, E. (2015). Hrm in development: Lessons and frontiers. Public Administration and Development, 35(2), 113-127. doi:10.1002/pad.1706

Elabore. (2014). Rich Pictures and CATWOE: Simple yet Powerful Scope-Modelling Techniques. (Online) Elabore8. Available at: https://elabor8.com.au/rich-pictures-and-catwoe-simple-yet-powerful-scope-modelling-techniques/ [Accessed on: 7/11/2019]

Getele, G., & Jean, A. (2018). Impact of business process re-engineering (bpr) implementation on customer satisfaction in e-commerce companies. Journal of Electronic Commerce in Organizations (jeco), 16(4), 41-52. doi:10.4018/JECO.2018100103

Gorgidze, I. (2012). System thinking in the control of organizational and technical problems (Management science - theory and applications). New York: Nova Science. (2012). Retrieved November 5, 2019, https://lesa.on.worldcat.org/oclc/852159082

Kashif, M., Rehman, M., Shukran, S., &Sarifuddin, S. (2015). Customer satisfaction and loyalty in malaysianislamic banks: A pakserv investigation. Marketing Intelligence and Planning, 33(1), 23-40. doi:10.1108/IJBM-08-2013-0084

Peters, D. (2014). The application of systems thinking in health: Why use systems thinking? Health Research Policy and Systems, 12(1). DOI:10.1186/1478-4505-12-51

Shukla, S. (2014). Emerging issues and challenges for hrm in public sectors banks of india. Procedia - Social and Behavioral Sciences, 133, 358-363. doi:10.1016/j.sbspro.2014.04.201 https://lesa.on.worldcat.org/oclc/5592546749

Singh, P., &Singhal, R. (2015). Emotional intelligence & customer satisfaction in indian banks. Indian Journal of Industrial Relations, 51(1), 70-80.

SSWM. (2019). Rich Picture. (Online) SSWM. Available at: https://sswm.info/planning-and-programming/exploring-tools/preliminary-assessment-current-status/rich-pictures [Accessed on: 7/11/2019]

Terra, L., &Passador, J. (2018). Strategic thinking in the context of complexity. Systems Research and Behavioral Science, 35(6), 869-883. DOI:10.1002/sres.2530