BUSI 601 Business Environment Ethics & Strategy

Get free samples written by our Top-Notch subject experts for taking assignment help services.

Introduction

Background

SNC Lavalin was established by a Swiss-born Arthur Surveyor in 1911 and in the early 1920s, his hard work,and dedication in delivering the services resulted in recognition among other engineering services in Montreal. Later on, along with engineering services, they expanded their work area internationally into infrastructure, oil & gas & mining and metallurgy sectors. A year later, in 1937, the 10-year partnership between Emin Nenniger and Georges Chênevert forms Surveyor's partners. In succession to it, another 10-year partnership was signed in 1947 and names the company as SNC (Surveyor, Nenniger & Chênevert). The company was recognized as a limited company in 1966 (SNC-Lavalin Group Inc., n.d.). The progressive increase from the 1970s resulted in generating the revenue of $180 million in 1981. In 1986, the company was listed in the Toronto stock exchange.

Parallelly, the Lavalin Company was founded by Jean-Paul Lalonde and Romeo Valois in 1936 and became Lavalin Inc. in 1970. Their work area was focussed on civil engineering. After several acquisitions, they had a turnover of $500 million in 1983 which was the largest by an engineering firm. However, these over acquisitions and expansions with loss-making companies were heading towards the overall losses and bankruptcy. As a consequence, the SNC took over Lavalin and formed SNC Lavalin Group in the third quarter of 1991. Since then, the company took over many other companies to collaborate and expand their work area.

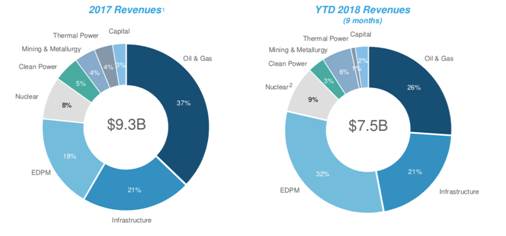

Currently, the company operates in six sectors namely, nuclear, clean power, EDPM (Engineering, Design and Project Management), Oil & gas, infrastructure, and mining and metallurgy.

Despite successes and growth, the company had gone through two major controversies. One was the Kerala Hydro-electric dam scandal where the company was accused of bribery and fraudulent. Another is the ongoing scandal where the company is facing the fraud and corruption case, at the preliminary stage. The company is accused of releasing $48 million to the Libyan government between 2001 and 2011. The consequence of charges will result in barring from bidding contracts of the federal government for 10 years (CBC-News, 2019).

Financial Performance

SNC Lavalin is Canada’s largest firm in engineering and construction management. As per the financial reports of 2017 the company has made $9150 million revenue and the company announces a strong Q3 2018 results with the net income of $121 million which as made an increase of 17% compared to Q3 of 2017. (SNC Press Release News, 2018).

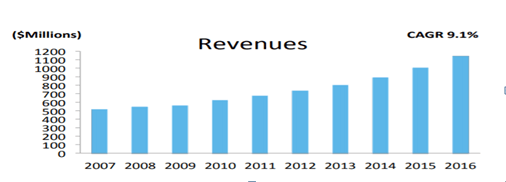

Revenue

The financial report provides the information obtained from the ratio analysis regarding the financial stability, profitability, and liquidity of the company.

The current financial status of SNC-Lavalin Company, as per the recent financial statement of 2017, it generated a revenue of $ 9,150 million in 2017 with 10.40% sales growth compared to 2016. The incremental revenue contributed from the Atkins, acquired on 3 July 2017, and partially from the infrastructure from the sale of the real estate facilities management business which is operating in Canada. (Jones, D. 2019, February 8).

The increase in revenue has led to:

- The stable operating cost of the company.

- Low-interest

- Increasing dividends to the shareholders.

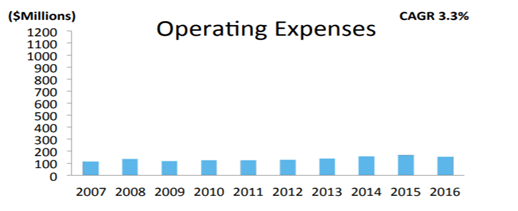

Budget and Operating Expenses

The net cash of the company which is used for operating activities increased by $341.5 million in 2017 as compared to 2016. The increase in this cash flow was due to the variations in the investing and finance activities of the Atkins acquisition. As per the budget, the cash and cash equivalents decreased by $349 million due to the repayment of the debt.

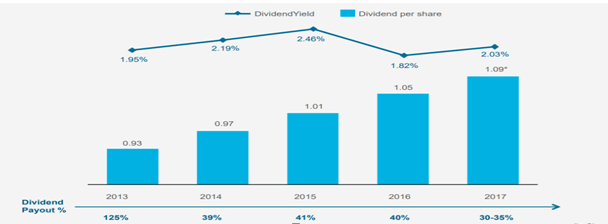

Capital and Dividends

In 2017, the net income attributable to the company's shareholderswas $382 million, there was a 50% increase in 2017 as compared to 2016. The President relates this increase with the major project of rail and transit division which achieved a turnaround performance in their infrastructure sector (Report, 2018).

Adjusted net income attribute to SNC-Lavalin shareholders from the E&C increased by $0.64 per diluted share due to the partial offset by higher net financial expense and a significant contribution from the oil and gas and infrastructure sectors. Hence increased the return to shareholders in the form of divided as 1.09 with the yield divided of 2.03%. (Fig 3)

Markets

SNC Lavalin is an international incorporated professional services and projects management company undertaking extensive projects on the latest technology and instruments in major markets around the world. SNC Lavalin group is leading among other companies that invest in infrastructure, construction and project management practices such as industrial buildings, highways, bridges, a transportation system that includes rail, airports and besides environmentally friendly infrastructure projects (SNC-Lavalin: Investor Presentation, 2018).

Moreover, SNC Lavalin companies have extended their mining and metallurgy projects globally in different countries such as Latin American, Asian, African, and European countries. The company also holds valuable experiences in the oil and gas market for more than one century in extracting, refining and marketing. SNC Lavalin is well-renowned for its performances and good relationship with customers and organizations. SNC Lavalin group is a full-service provider in itsnuclear sector. This company designs constructs and uses the new technology in building nuclear reactors. Generating heat and electricity are green products through the nuclear sector that contribute to the reduction of greenhouse gas emissions. Clean power is renewable energy that is produced from renewable resources. SNC Lavalin is one of the major companies that operate in designing, investing and delivering hydroelectricity, wind and solar energies in the clean power sector. SNC Lavalin Company has a concentration on sales promotion and enhancing efficiency to capture more global market share.

Competition

Recently, Canadian businesses have faced strict competition and are continually threatening by powerful companies in other countries. Some critical factors affect the competitive position of companies considerably. Human capital, financial resources, the power of marketing, bargaining power of the supplier and purchasers, and exist or new rivals. In order to survive, the companies have to follow high standards for quality of the productions, ethics and sustainability, and being a commitment to national and international rules. SNC Lavalin through having high multicultural networks and lowering the risk of its productions and services in essential sectors has succeeded to provide complete satisfaction for its customers around the world. Despite having strong rivals inside Canada, national borders have not supported this company from foreign competitive pressures. (Chiasson CP, P. 2019, February 08).

SNC Lavalin Company is challenging and competing with some great competitors such as Jacobs, KBR, WSP, and Stance that provide professional, technical and diversified construction services.

Jacobs Engineering was formed in the year 1947 and has made a revenue of $15 billion as per the financial report of 2018 and is more than the SNC Lavalin’s revenue this states that there is high competition between them. Another competitor is the KBR which is making a good net income of $434 million this states that the KBR is managing the funds and has a better budget as compared to SNC Lavalin this may lead to a challenging condition.

Market Analysis

SNC-Lavalin is a leading company in engineering and construction along with other sectors. Headquarters based at Montreal, the company have an employee strength of 52,448; as per 2017 annual report, 62% of employees of SNC Lavalin are employed in Oil and gas followed by Infrastructure (17%), power (10%) and others (SNC-Lavalin: Annual Report, 2018).

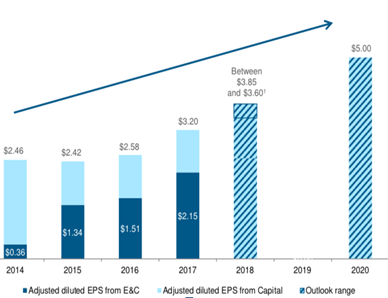

As per the 2017 statistics, the company had a net income of $383.2 million and faces a high competition from KBR (Net income: $434 million) followed by WSP (Net income: $213.3 million), Jacobs (Net income: $173.1 million) and Stantec (Net income: $97 million). The company's vision for 2020 focusses on achieving the recognition as a client-centric, continues the effort on operational excellence. From Figure 5, we can see the company upholds the expected trend of adjusted diluted EPS ($2.60 to $2.85) in E&C as per the 2018 report for Q3.

The company is expected to benefit in the future from the Atkins synergies after SNC-Lavalin took over the Atkins in 2017 and the same is reflected in Figure 6 in the year 2018. Concerning the decarbonize and stringent environmental laws, the company focusses on harnessing data and digital technology as reflected in the EDPM in Figure 6 where EPDM revenues increased from 18 % in 2017 to 32 % in Q3 2018 report. Similarly, individual expertise in CANDU (Canada DeuteriumUranium) nuclear reactor and Canada's two most significant projects with Bruce Power and OPG companies will keep the nuclear business upstream.

The MD&A (Management's Discussion and Analysis) predicted the increase of total EBIT in 2018 as compared to 2017, the definition of which was changed in 2017 where now it does not consider gains in the disposal of the head office of the building (SNC-Lavalin, 2018).

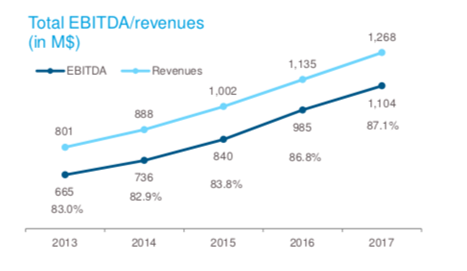

Figure 7 shows the trend of EBITDA and revenue for the past five years which can be useful in predicting the company's cash flow and its financial performance.

Moreover, as predicted in Figure5, the company anticipates the Compound Annual Growth Rate (CAGR) to be $5 by 2020 which is approximately 31.4 % increase compared to 2013 ($0.74). Comparing the SNC Lavalin's quarterly report (Q3) with Annual report 2017, the net income from E&C (Engineering and Construction) is $176.0 which contributes to the net income of $383.2 in 2017 as compared to 2016's $46.3. This increment is observed due to the contribution of Atkins, an increase in Oil & Gas and infrastructure.

Non-Market Analysis

Usually, the market environment established between organizations or other business-related parties take place through market relationship or private agreements like contracts. On the other hand, the non-market environment comprise social, legal, political, and technological aspects along private contracts and markets. These non-market factors affecting the business of SNC Lavalin’s business and growth are environmental protection, legislative politics, CSR, technology, and sustainability. The main objective of the non-market environment is to address the issues associated with these factors and improve the performance of the company. In this section, a few non-market factors have been analyzed.

PEST

It helps in understanding the impact of political, economic, social, and technological factors on the functioning of SNC Lavalin. Each Factor has been explained below:-

Political

Being a well-established company of Canada that deals in the engineering and construction field, the political environment can affect the ease of getting permits and licenses required to carry out the construction work (Staub-Bisang,2012). Due to political stability in Canada, the turbulence on the construction and engineering field is a bit moderate. However, new tax duty and government policies regarding the real estate industry might affect SNC Lavalin.

Economic

The investment-friendly reforms in the taxation system can act as a major driver for the economic performance of the company. In addition to this, ease of investments and availability of project investors aid the growth of the company. Canada is a financially stable country and US-Canada Free Trade Agreement and FDI might impact the revenue of the company in a positive way (Gibler& Lindholm, 2012). In addition to this, Canada has trade agreements with North America and Asian countries. Other factors, such as global recession, per capita income, rising interest rates on home loans, and much more can have many repercussions for the SNC Lavalin (Barwick& Pathak, 2015).

Social

Comparing the total income of Canadian families between 2005 and 2015, it grew from $63457 to $70336. This is higher than 10%. Demographic factor like an increase in the population increased the demand for homes and infrastructure in the country. On the other hand, traditions, customer preference, etc., have lowered the growth rate. However, education and health factors affect the business of SNC Lavalin (Staub-Bisang, 2012). It aims at making a positive contribution to society. SNC Lavalina is creating a favorable impact through its engineering and technologies, local employment, charitable, training, etc.

Technology

Canadian real estate is armed with some of the most advanced technologies and scientific research. The Internet has turned out to be the major game changer for SNC Lavalin. It has instigated online booking, renting, and purchasing the property. This has increased the market share of the company in the Canadian market. In addition to this, this has transformed the construction pattern with the time that has increased the age of the infrastructure.

Sustainability

As the company operates in the engineering and construction field, it is obligated to protect the environment and natural ecosystem while maintaining the productivity and profitability of the company. Currently, it carries out various environmental initiatives that are undertaken at a different project. For instance, at John Hart Generating Replacement Project, the company is obligated to protect the water quality while the project was taking place. For that purpose, it provided special environmental training to the crews who work on the projects prior to initiating the project. The training and employment for the low skilled employees have been a great contributor in improving the productivity of the company (Wirth, et.al, 2016). Being a part of the real estate industry of Canada, SNC Lavalina had a hard time while reconciling the environmental, social, and economic objectives. With time, the stakeholders’ expectation and legal responsibilities have risen across Canada. Currently, the company is considering ecological, ethical, and social criteria in its decisions regarding investment. The company is aiming to deliver sustainability in all of its projects. It contributions comprise project-related economic spinoffs.

Legislation

The Canadian construction industry is governed by the Canadian Construction Documents Committee is one of the national committees that govern development, production, and review of the agreements. In addition to this, the Royal Architectural Institute of Canada (RAIC)and Ontario Architects Association (OAA) that controls the construction industry. Lavalin to follow the guidelines given by these governing bodies. The documents of CCDC are considered as precedents for each and every contract formed by SNC Lavalina. It is required from SNC to abide by the environmental laws and obligations. In addition to this, the Canadian government is very concerned about the employees in the construction field as a large number of people are employed in the construction sector. Hence, it is required from the company to respect the employment-related legislation. Another legal requirement mandatory for the company is health and safety norms as construction work is full of risks and health hazards. Therefore, it is required by the company to follow those norms.

Corporate social responsibility/Ethics

CSR is the response that a business entity gives to the sustainable development challenge and it carries out modus operandi of carrying out operations in order to have a positive image and impact on the employees. CSR helps in developing trust among the community that the company is not only making profits but also it is benefitting the community. SNC Lavalina’s operations are impacting society, environment, and society directly or indirectly (Asmeri, et.al, 2017). The CSR policies of a company focus on social and community objectives, environmental sustainability, ethical issues, and business commitments and business relationships. SNC Lavalin is very much committed towards corporate social responsibility and they are dedicated to ensuring that the operations and projects meet the sustainability standards (Sanbur& Gultekin, 2019). The company expects the employees to understand the procedures and policies and bring them into action irrespective of the challenging and unfavorable circumstances.

SWOT Analysis

|

Strengths · Large scale company with over 30,000 employees · A high standard is maintained in all projects · Lesser risk due to involvement in the diverse sector, such as chemicals, agrifood, mass transit, etc. |

Weaknesses · Poor brand image due to involvement in scandals and negative publicity · Poor leadership stability as executives are resigning · Increasing debts on the organization due to instability in the construction sector. |

|

Opportunities · Partnerships and Tie-ups can improve profitability and brand image. · Underdeveloped economies have higher growth potential for NSC Lavalina · Projects and political decisions to improve the infrastructure facilities within Canada. |

Threats · Unfavorable government policies, global economic recession · Price inflation of raw material can increase project cost · Rising competition from international markets |

Critical Factor Analysis

For this section, four items have been selected that will be analyzed and a separate action plan will be developed to improve them or mitigate their side-effects. These items are:-

- Rising competition from international markets

- Rising project cost

- Economic Recessions

- Poor Brand Image of the company.

These have been selected because these might be having the major impacts on the growth and profitability of SNC Lavalin. Either they are a threat to the company or major weakness for the company. An action plan for each item is formulated below:-

Rising Competition

The major competitors of SNC Lavalin are Siemens Energy, ALSTOM, and Foster. There are many strategies to deal with rising competition. An action plan is provided below:-

|

Item |

Barriers to Overcome |

Time Allotted |

Measures to be taken |

|

Rising Competition |

The inexperience of forming a competitive strategy, poor evaluation of resource, and poor leadership |

1 Month |

· Management of working environment for employee motivation and improvement of organizational productivity. · Building co-operation among departments and gaining support at each level of the management. · Developing strategies that address the needs of every stakeholder’s requirement. · Demonstrating market leadership, educating consumers, clients, and investors (Sanbur& Gultekin, 2019). · Carrying out social work to improve brand image. · Ensuring the projects are meeting the desired standards and legal obligations. · Carry out relevant and valid market research (Rumane, 2016). · Form an alliance with other leaders in the market and organizations. · Invest resources in public relation in order to maintain the existing customer base. · Merge the public relations and marketing efforts with some traditional forms of advertising and campaigning. · Investing in developing community outreach initiative that helps in involving the firm and its domain of expertise. |

Rising Project Cost

The project cost might increase due to many reasons, such an increase in the cost of raw materials, an increase in the project cost, an increase in the labor cost and machinery, and much more. Hence, this cost must be controlled. The action plan is given below:-

|

Item |

Barriers to Overcome |

Time Allotted |

Measures to be taken |

|

Rising Project Cost |

Project scope is tough to control and inflation rate depends on external factors that are beyond the control of the organization. |

1 Month |

· Determining cost rates of all the resources, such as material, machinery, and labor. In addition to this, all the materials that might be needed for the completion of the project will be charged as per the decided rates (Tyagi, et.al, 2015). · Analyzing the vendor bid. This provides the best bid that is lower and is most effective for the company. · In order to save the cost, the wastage of the raw materials needs to be minimized. This would help in getting the project completed well within budget (Tyagi, et.al, 2015). · SNC Lavalin needs to consider the bottom-up estimation technique as it is most accurate, time-consuming, and can be used in determining the cost of each item. |

Economic Recessions

Canada was severely affected by the global recession of 2008 as it was a time unemployment rate was skyrocketing. The construction industry was also deeply impacted by the economic recessions as the demand for the properties decreases(Rumane, 2016). To avoid such things in business, an action plan is provided.

|

Item |

Barriers to Overcome |

Time Allotted |

Measures to be taken |

|

Economic Recessions |

The impacts of recessions are short-term as well as long-term. The latter effects might take some time to detect and many a time, a few of them are difficult to detect and they eventually impact the overall strategy. |

1 Month |

· Defining timeframes for each possible scenario. It is important to discard all the open-ended scenarios. · Establishing all the prime variables associated with each scenario. This might be very useful in presenting threats and opportunities to the business. · The last step is developing a trigger point. |

Poor Brand Image

|

Item |

Barriers to Overcome |

Time Allotted |

Measures to be taken |

|

Poor Brand Image |

The inexperience of forming branding and marketing strategy, poor leadership, and poor productivity and low customer satisfaction. |

1 Month |

· Community development and uplifting initiative can build confidence in people about the brand. · Internet marketing can be very useful in penetrating the existing market of Canada and enter the international market. In addition to this, it can help in reaching the larger section of the society and promote the company (Zhang, et.al, 2016). · Responding and addressing the queries of the client in order to make them feel that the company is doing charity. · Designate a spokesperson that support and address the queries. · Invest resources in public relation in order to maintain the existing customer base. · Club the public relations and marketing efforts with some traditional forms of advertising and campaigning. · Investing in developing community outreach initiative that helps in involving the firm and its domain of expertise (Rumane, 2016). |

Conclusions

Here, the market and non-market analysis of SNC Lavalina had been done. Various aspects had been elaborated. For instance, in the introduction part, it was discussed that the company had expanded in the field of metallurgy and ore extraction. The decision was accepted because the revenue was increasing too. No doubt, this had decreased the risks of the poor performer in the market, but there are some potential challenges that have emerged. For example, there has been an increase in the competition from the national and international market.

Talking about the future prospects for the next five years, the company should focus on sustainable growth, cash generation, and project execution. The company must formulate a capital allocation strategy that aims at strengthening the financial accounts, balance sheet, bringing additional flexibility and firmness in the business operation. In addition to this, the company should make efforts to consider the geopolitical and economic events hindering the growth of the company and planning strategies for the same (Sanbur& Gultekin, 2019). Coming on to the project execution, the management should review and analyze the segment portfolio of the company and its geographical remarks. Furthermore, the company should aim at reducing the project delivery time by making use of the most advanced technology and well-learned and experienced employees who need minimal training.

Talking about the next 10-year prospect of SNC Lavalina, the company will be focusing on organic growth pattern in the particular field of business. For that purpose, it will be focusing on progressing with operational excellence, establishing a customer-centric company, developing and promoting a performance-driven culture, expanding the business in Canada and other parts of the world. Lastly, delivering better returns to the shareholders (Sanbur& Gultekin, 2019). For that purpose, the company has to leverage its position in the primary segment and market. In addition to this, in the real estate market, the company is planning to grow in its engineering and P3 markets in the UK and Canada. The expansion will also take place in the US as well as the company is aiming at global expansion in the coming 10 years. In addition to this, due to the high potential of construction work, the company will be investing in the Middle East, Asia-Pacific, and UAE. By building long term partnerships, the company is aiming at expanding in the region outsider Canada. The company is planning to take more sustainable approaches for its mining and metallurgy business, thereby contributing to both business and society.

The company is aiming at creating differentiation in order to beat the competition. For this purpose, it is planning to invest in the technology and expertise of people by training them to prepare for changing technology and business scenarios (Shen& Long, 2017). It is planning to come up with a digital platform so as to improve the project delivery method and expanding the offered services. Overall, the company is aiming to improve its reputation and image so as to get more and more projects and government tenders.

Infogram

References

Asmeri, R., Alvionita, T., & Gunardi, A. (2017). CSR disclosures in the mining industry: Empirical evidence from listed mining firms in Indonesia. Indonesian Journal of Sustainability Accounting and Management, 1(1), 16-22.

Barwick, P. J., & Pathak, P. A. (2015). The costs of free entry: an empirical study of real estate agents in Greater Boston. The RAND Journal of Economics, 46(1), 103-145.

CBC-News. (2019, February 08). A closer look at SNC-Lavalin's sometimes murky past. Retrieved February 09, 2019, from CBC News: https://www.cbc.ca/news/canada/snc-lavalin-corruption-fraud-bribery-libya-muhc-1.5010865

Gibler, K. M., & Lindholm, A. L. (2012). A test of corporate real estate strategies and operating decisions in support of core business strategies. Journal of Property Research, 29(1), 25-48.

Jones, D. (2019, February 8). The wall street Journal. Retrieved from https://quotes.wsj.com/CA/XTSE/SNC/financials/annual/income-statement.

Rumane, A. R. (2016). Quality management in construction projects. CRC Press.

Sanbur, A., & Gultekin, A. B. (2019). Multi-Dimensional Approaches to the Development of Sustainable Real Estate Valuation Principles. In IOP Conference Series: Materials Science and Engineering (Vol. 471, No. 10, p. 102035). IOP Publishing.

Shen, L., Zhang, Z., & Long, Z. (2017). Significant barriers to green procurement in real estate development. Resources, Conservation and Recycling, 116, 160-168.

SNC Lavalin Competitors and Alternatives. (2018.). Retrieved from https://craft.co/snc-lavalin/competitors

SNC-Lavalin announces strong Q3 2018 results, with a net income attributable to shareholders of $121 million, up 17% from Q3 2017. (n.d.). Retrieved from http://www.snclavalin.com/en/news/2018/snc-lavalin-announces-q3-2018-results.

SNC-Lavalin Group Inc. (n.d.). Retrieved from Company-Histories.com: http://www.company-histories.com/SNCLavalin-Group-Inc-Company-History.html

SNC-Lavalin. (2018, April 03). 2017 Annual Report. Retrieved February 08, 2019, from SNC-Lavalin: http://www.snclavalin.com/en/files/documents/2017-annual-snc-lavalin-annual-report_en.pdf

SNC-Lavalin. (2018, November). Investor Presentation. Retrieved February 08, 2019, from SNC-Lavalin: http://www.snclavalin.com/en/files/documents/ir-presentation-overview_en.pdf

Staub-Bisang, M. (2012). Sustainable investing for institutional investors: risks, regulations, and strategies. John Wiley & Sons.

The Canadian Press. (2019, January 28). SNC-Lavalin mulls retreat from Saudi Arabia amid deepening diplomatic row. Retrieved February 09, 2019, from Powell River Peak:https://www.prpeak.com/snc-lavalin-mulls-retreat-from-saudi-arabia-amid-deepening-diplomatic-row-1.23614169.

Tyagi, S., Choudhary, A., Cai, X., & Yang, K. (2015). Value stream mapping to reduce the lead-time of a product development process. International Journal of Production Economics, 160, 202-212.

Wirth, H., Kulczycka, J., Hausner, J., & Koński, M. (2016). Corporate Social Responsibility: Communication about social and environmental disclosure by large and small copper mining companies. Resources Policy, 49, 53-60.

Zhang, D., Zhu, P., & Ye, Y. (2016). The effects of E-commerce on the demand for commercial real estate. Cities, 51, 106-120.

Chiasson/CP, P. (2019, February 08). Federal public prosecutor asks the court to strike SNC-Lavalin plea for the deal. Retrieved from https://calgaryherald.com/pmn/news-pmn/canada-news-pmn/federal-public-prosecutor-asks-court-to-strike-snc-lavalin-plea-for-deal/wcm/93cc0e6b-20bc-4441-a614-145f3b2996c0.