- Retail Banking Assignment Sample

- Introduction

- Overview of the UK’s Retail Banking Sector

- Background of Barclays

- Barclays Operating Model in the UK

- High Street Presence of Barclays

- The relevance of Consumer Loyalty for Barclays

- Relationship Building and Customer Service

- Positives Impacts of Deregulations on Barclays

- Side-effects of Deregulation

- Recommendations for the Retail Banking Sector

- Conclusion

- References

Retail Banking Assignment Sample

Introduction

Retail banks are commercial banks that operate in the mass banking market, wherein the customers might avail almost all the services associated with the banking sectors. These comprise services related to debit/credit, loans, accounts, and mortgages, etc. The main focus of retail banking is on the individual customers and their demands. The retail banking targets on becoming a one-stop shop providing a wide range of financial services. The core services provided by the retail banks can be divided into three categories, such as core banking services, peripheral banking services, and secondary banking services. There are many characteristics of retail banks. The first one is that such banks make use of their internal and external resources and space for promoting and cross-selling services. The other characteristics are that they are governed by banking regulations.

In the following report, a critical evaluation of retail banking's operational planning is done. It comprises the impact of high street presence on operational planning and performance of the Barclays. In addition to this, an analysis of customer buying power and its effect on operational planning and business practices. It explains the importance of operational decision in retail banking. Moreover, it elucidates the significance of relationship building with the customer. Evaluation of customer service and customer relationship is also done for a better understanding of the retail banking operations and a basic comprehension of deregulated market risks. Furthermore, the side-effects of changing operations of Barclays is discussed here.

Overview of the UK’s Retail Banking Sector

The retail banking sector is currently a competitive and dynamic sector in the UK. It is currently under the threat of losing the market share. The market is strongly dominated by a few high street banks, namely HSBC, Lloyds TSB Bank PLC, Barclays, and Royal Bank of Scotland Group PLC (RBS). They have a higher proportion of the customers who are loyal and tend to have high priced accounts. This may be because they have higher services and high incentives than other small retailing banks. The current market is strongly driven by technology, customers, and agile innovation. The market is controlled by regulations. Talking about past trends in the market, the retail banks are very active and react to the change very quickly. They change their corporate behaviour in response to the changes in the external environment that comprise political, legal, social, economic, technological, and environmental factors. In the deep recession era of 1973-82, the majority of the banks in the UK started investing in the international market as the growth rates and returns were high in comparison to the local market (Angelshaug and Saebi, 2017). This instigated the market for investment banking. However, the international debt crisis, disintermediation, and securitisation of banks forced them to focus their attention back to the domestic market.

In addition to this, there are some externally induced changes affecting the market of the retail banking sector (Tansuhaj, et.al, 2014). The first is the disclosure of the overall profits of the banks. In the UK, the banks are supposed to declare their profits in their annual reports so as to increase the awareness for higher profitability targets and cost reduction. Another trend is the merger. In the late 1960s, there were extensive mergers happened in the UK, especially in the banking sector. The trend is still ongoing as the high street banks are focusing on controlling cost and capturing more and more share in the banking market. After the global recession of 2008, many mergers took place. The third trend is deregulation that impacted the banking sector. Usually, the retail banks work on the agreement that they would not compete on prices. Furthermore, the market is very restrictive and is quite difficult for the new entrants to make an entry in the market. This led to the deregulation of the finance and banking sector. As a virtue of this, the Competition and Credit Control was introduced in 1971 as the first deregulatory step taken up by the government. This has tremendously increased the competition in the banking sector (Angelshaug and Saebi, 2017). Another factor is inflation which is still impacting the finance sector around the globe. The high and volatile rate of inflation is increasing the risks for the banks and increased the uncertainties in the market. Banks are constantly changing their operating formulas and floating rates. New lending techniques are coming up that are way far from traditional banking approach. In order to cater to this, various concepts have been introduced, such as financial futures, financial options, and swaps.

In addition to this, there are some internal changes that are affecting the retail banking sector since the 1970s. The key external catalysts of change were undoubtedly increased competition, high rates of inflation, and deregulation. As explained already in the above paragraph that retail banks became more profitable, competitive, and cost control conscious. Moreover, many aggressive marketing policies were introduced in the banking sector. The internal factors comprise the non-prices competition. Earlier there was no or very little non-price competition in the banking sectors in terms of customer service. Nowadays, customer services are coming up as non-price competition. In addition to this, increasing customer profitability and reducing customer attrition are other non-price competition parameters. In addition to this, new funding techniques are also some internal factors affecting the retail banking sector.

The increased awareness of the profitability of banks, risks associated with them in the market, and dramatic decline in the market share forced banks to reassess and evaluate their position and performance in the high-cost retail banking sector. In contrast to the business sector, the personal one grew more profoundly in terms of absolute size and sophistication. Deregulation also played a major role in the rise of the retail banking sector as the banks could compete for the first time in the rapidly increasing and growing house mortgage market.

Background of Barclays

Barclays Plc. is one of the British multinational banks headquartered in London. The company operates in four core areas, namely corporate banking, personal banking, investment management, and wealth management. The investment and corporate banking and Investment and wealth management cluster comprise three units of the business. Furthermore, the retail and business banking section has four business units, namely Europe Retail Banking, Africa Retail and Business Banking, UK Retail, and Business Banking, and Barclaycard. Currently, it employs over 80,000 employees and the annual revenue of the company is £21.076 billion. The company is operating in the banking field since the last 328 years. In the past 50 years, the company is developing in different markets around the globe (Allen, et.al, 2012). It has developed a market-leading payment business in the past five decades. Currently, it has established the banking franchise in the UK, Europe, US, and India. Barclays has more than 4700 branches in more than 55 countries of the world out of which 1600 are in the UK alone. In addition to this, in the United Kingdom, Barclays offers quite a few banking services via its post offices.

Barclays Operating Model in the UK

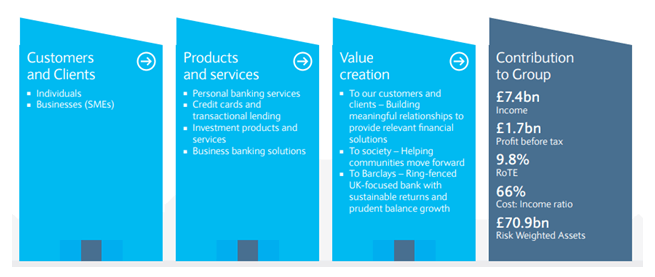

Against the uncertainties in the economic and political climate of the UK, Barclays is working hard to provide quality services in the UK and other parts of the world. It provides solid innovative and financial solutions to the customers and clients. The operating environment is very challenging for the organisation due to rapidly changing business scenarios that include changing customer preferences, technology, and other factors. In addition to this, deregulation of the financial sector and globalisation have significantly impacted the competition level in the domestic market as well in the international market. Increasing expectations of the customers and the regulations from international and national agencies are other factors. The major foundational pillar for the company is the large consumer base that helps it in staying stable and competitive in the financial sector of the UK. The basic operational model of Barclays has been shown in the fig.1.

In addition to this, Barclays's diversification model gives it significant resilience and strength. With its two division, namely Barclays International and Barclays UK, the company is providing services to the retail customers and clients through start-ups. They run across business geographies and lines that help the company in reducing the risks of operating just in one market or country or economy and catering to only a single consumer segment (Froud, et.al, 2017). It is operating in both the retail and wholesale banking sector that minimises the volatility of the overall earning of the organisation. Furthermore, it helps in delivering sustainable returns with the help of the economic cycle. In addition to this, it retains flexibility and consistency so as to align its resources for maximising opportunities and supporting growth in various sections of the business (Allen, et.al, 2012).

It gives immense importance to digital safety in the era of rapidly changing world of technology. It aims at increasing consumer awareness towards digital safety and educate them so to make them more concern and engage. In the year 2017, Barclay launched a campaign that aimed at country-wide consumer engagement. It highlighted the significance of digital safety. Since the company provides online services, such as online bill payment, shop online, money transfer, and much more, it is important to protect the customers from cyberspace attack and scams. For many customers and clients, the initiative was very useful as it helped them in gaining confidence for making an online transaction. However, having the confidence for working and making transaction form digital platform does not mean that it is safe to do so. This campaign helped the company in its leadership role and got them recognised and appreciated by the government. Talking about the risks associated with the operating model, the company continuously operate and monitor the leading indicators to determine the economic performance trend in the UK, especially after Brexit uncertainties and low-interest rate. Barclays is determined to remain conservative and well-performing post-Brexit with the help of its strong framework to manage the risks and proactive approach to handle them. In addition, to remain competitive in the market and provide innovative banking solutions to the clients and customers, the company is investing largely in purchasing technology and developing some of its own. This aims at simplifying the banking experience and procedure and providing additional safety to the customers who prefer doing online transactions. With its highly effective cyber-security solutions, it is improving its threat detection and response abilities and implementing new standards and approaches that are resilient.

High Street Presence of Barclays

It is important to understand the term “High Street” which was originated in the UK. The high street banks are those categories of banks that have numerous branches. The reason for calling them high street is that they have a humungous capital base and their operations are taking place throughout the UK. Usually, these banks have their locations in the main CBD of the city or town. Their main aim is to provide all the banking services and that too personalised to the customers (Tansuhaj, et.al, 2014). As it has already been discussed that Barclays has numerous branches across the UK and other countries. The main reason for the development of such a wide branch network is the unplanned and evolutionary growth and the mergers that occurred in the past forty years.

In order to be called the high street bank, it was important for Barclays to expand in the international market and it was a significant part of the business journey of the company. Barclays understood that overseas expansion could be both rewarding and scary at the same time. Along with the high demand for the goods and services from the UK around the world, there are a plethora of opportunities offered by the export market. Barclays understands that smaller organisations cannot afford international expansion due to lack of resources and high risks. However, small businesses can easily adapt to changing conditions and new situations. This flexibility is missing in the big organisations like Barclays. It is important for Barclays and the small businesses that they can withstand the large pressures exerted from the domestic market and that they are not disregarding their loyal customers in the local market. Another important thing that Barclays did while expanding its network was building relationships and bridging the gap between culture and business practices. It believed that the success of operating in the international market lies in intertwining with local organisations. It tried to understand and respect the culture and business procedures of local businesses. The cultural gap might affect the business when expanding and branching out in the international market. In addition to this, understanding the local cultural practices, languages, and business regulations greatly helped the company in building trusted relationships with the local businessesand their local customers. It is important for retail banks to create trust among international businesses and customers in order to thrive and make a huge investment of time and energy. For that purpose, understanding language and culture played a vital role for Barclays. They got their foot in the door in the international market through the overseas network and corporate relationship.

In order to create a huge network across the world, Barclays has its own approach. They transform themselves so as to become flexible, learner, and adaptable. This helped them to outclass the larger competitors. They understand the interest of customers in the international market and respect their culture. This greatly helped them in building trusted relationships and networks with them and the local businesses with whom they are aiming to form mergers. Another thing that worked for Barclays was getting on boards the suppliers and other strategic partners at a very early stage so to gain their support.

The relevance of Consumer Loyalty for Barclays

Customer loyalty is the most significant aspect of every business and retail bank are aiming for it. However, there are many forces that encourage switching behaviour among them. These comprise rising consumer knowledge and awareness, increasing alternatives, changing demand and expectations, cost of switching, ease of access, and lastly sophisticated consumer behaviour (Adudaand Kingoo, 2012).Another important aspect is consumer retention which is one of the threatening aspects for banks and other financial institutions. For increasing the retention of the customers, banks are working really hard. Since financial bodies and their services have transitioned from high personal interaction to remote contact through the Internet and phones. Consequently, banks and other organizations need to take into account customer loyalty's antecedents. A deep understanding of those antecedents and their importance in order to increase customer loyalty.

Firstly, it is important to understand the dimensions and concepts of consumer behavior. It is based on the factors, such as frequency of purchase, amount of purchase, cost of brand switching, brand satisfaction among consumers, etc. In addition to this, there is some attitudinal approach that is based on consumer attitude, dispositions towards organisation, and preferences. This approach is an evolving process and might affect the cognitive ability of customers. Talking about customer loyalty in the retail banking sector, they are many industry-specific issues affecting consumer behaviour and loyalty (Froud, et.al, 2017). The nature of the interaction between customers and banking services provider, level of customisation, the degree of commoditisation, and ways of offering services, delivery channel, etc., are important factors that help the banks in understanding the customer loyalty in the sector.

Barclays considers customer loyalty in terms of the number of time customers has been with them, the number of services avail by them, and how often they use those services. They have given their own comprehensive definition of customer loyalty which is based on various dimensions, such as cognitive, conative, effective, and behavioural loyalty. Customer loyalty is considered to have the following aspects (Sharpe, 2016):-

- Intentions for repurchasing the services for a longer term

- High degree preferences of consumers

- Low probability for switching

- Price indifference

- Advocacy and recommendations by customers

Barclays offer mortgages, savings, and banking. In addition to this, with its retail services, Barclays serves over 24 million customers around the world. Being a high street retail bank, Barclays aims at customer satisfaction and relationship building. For that purpose, Barclays has launched a mobile banking app for the customers in order to arm them with an ability to stop retailing with some retailers. It became the first bank in the UK to do so. Barclays introduced the feature for the customers while keeping the vulnerable circumstances in the head. However, the feature is useful for the customers as it gives them greater control over their spending and prevents themselves from any kind of scams or frauds. It is currently working with a number of financial advisors and service providers, namely Money Advice Trust so as to build a safe and trusted platform for the customers. This would help in easing the online transaction and giving better control of their spending to the customers. Barclays is targeting those customers who are concerned about their finances and want to handle their expenses in a better way. Only with a single button in the Barclays’s mobile banking app, the customers can choose the type of retailer they want to spend their money with and those transactions will be cancelled automatically for which the customers have selected the ‘turned off’ button.

The organisation is continuously looking for ways in order to enhance the experience of its client and customers through its innovative solutions and services delivered by it. Being a retail bank, consumer satisfaction is the focal point around which all the banking operations revolve. Hence, the company is aiming at reducing the customer's complaints and address the issues that they face while banking. In addition to this, Barclays provide personalised fraud-related hints and tips to safeguard the customers. It has developed a Fraud Fighter Tool in order to help the customers comprehend the vulnerable sources and websites that can cause mischief with the customers. It provides personalised tips for fraud preventions.

Relationship Building and Customer Service

According to Ernst and Young, trust is the quintessential part of the banking sector. This is because it decides the customer base and loyalty. In the UK, building a trusted relationship with the customers is important for the banks as it decides their position in the market. According to the global survey conducted by EY, nearly 60% of global customers believe that retail banks have a significant role in their day-to-day lives. They provide their customised expertise to the customers in easing off their banking tasks (Adudaand Kingoo, 2012).

Barclays is working really hard to provide banking services and solutions while simultaneously taking measures to increase cybersecurity. Banks cannot reduce their reliance on the technology but they can improve them so as to protect the data and other client-related information. This could be an attempt to improve their relationship with customers. Barclays is currently making use of the relationship banking approach so as to strengthen the loyalty of customers (Bootand Thakor, 2012). This is a consultative approach taken up by the bank so to understand the needs and demands of the customers that might change with time. Such banks offer various services, such as insurance, credit cards, investment management, certificates of deposits, loans, etc. In addition to this, they might also have financial products for different demography and economies (Angelshaug and Saebi, 2017). As an attempt, Barclays also targeting premier customers through its reward system. They provide freebies and discounts to their loyal and premier customers as a token of reward. Barclays understand the fact that more the customer interacts with the banks, lesser they are engaged. To reduce this possibility, the bank is addressing the customers in a better way.

Positives Impacts of Deregulations on Barclays

Deregulation is the step taken up by the government of the UK in an attempt to reduce the restrictions on the finance sector and banking sector. The major goals of doing so were to make the business easy to carry out. It removes the legislation and rules that interfere with the organisations' abilities to compete in the domestic as well as in the international market. The main motivation for such economic liberalisation action was to strengthen the national economy and increase the competition in the banking sector (Beju&Ciupac-Ulici, 2012). This would increase the service quality and efficiency of the organisation. This paradigm is based on the fact that organisations in the finance sector would maximise their values and increase the number of competitors in the market by lowering down the market entry and exit cost. The deregulation has a positive impact on the business organisation, especially the smaller ones. The firms indulged in R&D have a positive impact of deregulation in the banking sector. The bank relationships were improved and ease of getting loans for running the business was also increased (Mullineux, 2012). In addition to this, trade credits got reduced that increased the investment in the intangible assets.

Due to deregulation, the banks of the UK, such as Barclays and HSBC could invest in the international market that was offering higher returns and profits. The era of deregulation was also the time of deep global recession. In order to attract capital from the global market, the government could cement the finance sector of the country. Barclays grew too quickly in the international market by forming mergers with the local leaders. It fostered its financial position and network. It becomes too large to avoid any financial discrepancies. Due to the dismantling of the barriers between retail banking and investment banking, Barclays became the high street retail banking. Various mergers took place and Barclays acquired a large amount of debt that turned out to be a profitable investment. However, the international debt crisis, disintermediation, and securitisation of banks forced them to focus their attention back to the domestic market. Due to the drop in the housing market, the majority of the banks in the UK failed and got bailed out by making use of taxpayers fund by the government.

Side-effects of Deregulation

Once the government of the UK declared the deregulation, there had been a tremendous change in the banking sector of the UK. The commercial banks were entered into many finance related activities indirectly or directly through the development of a bank subsidiary. In order to enter activities allowed as per the guidelines of the Bank Holding Company Act. The major setback of the deregulation was that it increased the competition for the smaller banks as a result of which they hardly had any choice except to merge with the large banks. Barclays also played the same game (Allen, et.al, 2012). The banking sector was dealing in the unpoliced market only big banks are dominating and there was little or no room for the small banks. Deregulation resulted in a situation where the risks were spread out in the whole banking sector rather than confining to a particular bank. The FSA could not be able to determine this risk. The deregulation resulted in the formulation of policies that focused on aggressive growth. It resulted in the complete dissolution of many banks (Beju&Ciupac-Ulici, 2012).

The main aim of deregulation was to improve the efficiency of the banks and remove the uncertainties. However, a few of them remained in the system. With the increase in capital investment in the banking sector, the control and stakes of the government in the sector came down. In the case of very weak regulation, the banking sectors have a high chance of banking crises (Tabak, et.al, 2015). Many research papers have shown that deregulation of the banking sector is cautious for the new banks as it hinders their access in the market. Due to the rise in the competition in the market, the banks choose competitive models. The model does not consider the sector segmentation or regional bifurcation. In addition to this, during the deregulation, it has been noticed that liberalisation of the capital account is usually slow and cautious.

The deregulation cannot be called a major hit as the empirical studies have proved that cost productivity reduces due to deregulation. In addition to this, due to deregulation, banks have to transfer a portion of their market power to the depositors in terms of escalated interest rates on the deposit amount .This has tremendously increased the cost of funds of the banks like Barclays. Furthermore, cost productivity decreases due to deregulation as banks are required to provide services to the customers in order to increase customer loyalty and satisfaction. This put tremendous pressure on the banks to provide high-quality services but reduces their revenues (Beju&Ciupac-Ulici, 2012).

Recommendations for the Retail Banking Sector

The banking sectors work on consumer satisfaction and their trust level. Hence, here are some piece of advice to the high street banks of the UK:-

The first and foremost advice is to promote a customer-centric culture. This can be done by setting up the right environment that is friendly and helping. Retail banks need to use the right incentives at each and every organisational level. In order to have a long-lasting relationship, the banks need to carry out some trust-building initiatives, such as rewarding loyal customers and premier clients(Adudaand Kingoo, 2012)A set of continually and clearly articulated principles and values along with rewarding the loyal behaviour is crucial to promote so as to build the customer-centric culture and trust-driven approach.

The second advice is to offer transparency in services, especially those related to the transaction and product offering. It has been seen in the research of EY that only 32% of the consumers of the retail banking sector have 100% trust in the banking service providers. The remaining 68% of them feel that banks are not fully transparent in providing services and charging fees for the services it provides, such as debit and credit card services (Saunders, et.al, 2014). It has been that when consumers do not feel that the bank is transparent about its charges and fees, they try to switch to other banks and are less likely to recommend it to their friends.

The third advice to the banks is to provide better safety and security to the customer data. This can be done by making use of the best technology and innovative solutions. In addition this, it is also important for the bank to upgrade their existing model of banking services. According to the survey by EY, nearly two-thirds of the global customers of banks are worried about their information might get stolen and their cards might result in big financial fraud. This is the major concern for most of the banks and their customers. In order to address this issue, banks are required to update their security infrastructure, upgrade their risks management plan, take consultancy from security providers and software developers, update their procedures and technology in order to avoid any data breach or security attack (Ngoand Nguyen, 2016). In addition to this, it is very difficult for banks to create the right balance between security and convenience. However, banks can work with security providers to update their online platform on regular basis.

It is also advised to the banks that they should expand into new markets and economies so to develop an ecosystem of world-class services and products. The focus should be given to the non-financial services that customers demand. One thing to take care of here is that emphasis on a relationship's transactional element should be lowered down. As banks focus on improving the relationships with the customers, the initiatives should be taken for developing long-term financial relationships (Saunders, et.al, 2014). The banks should seize the opportunity to foster trust and relationships with the customers and develop trusted brands as a way to differentiate themselves from existing and new competitors.

Conclusion

Here, a thorough discussion on theretail banking sector was done. For a better understanding of the issues that the high street banks in the UK face, Barclays had been selected. It was seen that Barclays's current operating model focuses on the diversification of services in order to capture the market and increase customer satisfaction. In addition to this, the risks associated with the current model were also highlighted and the management approach was also outlined. It was seen that the center administrations given by the retail banks can be divided into three class, for example, centre keeping money administrations, fringe managing account administrations, and optional saving money administrations. There are numerous attributes of retail banks. The first is that such banks make utilization of their interior and outer assets and space for advancing and strategically pitching administrations. Alternate attributes are that they are represented by managing an account guideline. The importance of the relationship building for the banks in the retail market was elucidated. In addition to this, the external and internal trends affecting the business were also discussed and their impacts on the retail banks were also elaborated in the report. The two main issues that the retail banks face, namely deregulation and customer satisfaction and relationship were thoroughly discussed and analysed critically. The positives and negatives of deregulation have been discussed in-depth in the context of the retail banking sector.

References

- Aduda, J. and Kingoo, N., 2012. The relationship between electronic banking and financial performance among commercial banks in Kenya. Journal of Finance and investment Analysis, 1(3), pp.99-118.

- Allen, F., Babus, A. and Carletti, E., 2012. Asset commonality, debt maturity and systemic risk. Journal of Financial Economics, 104(3), pp.519-534.

- Angelshaug, Magne. andSaebi, Tina 2017. The Burning Platform of Retail Banking. The European Business Review, 5, pp.30-35.

- Beju, D. G., &Ciupac-Ulici, M.-L. 2012. The Impact of Financial Liberalization on Banking System. Procedia Economics and Finance, 3, 792–799.

- Boot, A.W. and Thakor, A.V., 2012. Can relationship banking survive competition?. The journal of Finance, 55(2), pp.679-713.

- Froud, J., Tischer, D. and Williams, K., 2017. It is the business model… Reframing the problems of UK retail banking. Critical Perspectives on Accounting, 42, pp.1-19.

- Hoffmann, A.O. and Birnbrich, C., 2012. The impact of fraud prevention on bank-customer relationships: An empirical investigation in retail banking. International journal of bank marketing, 30(5), pp.390-407.

- Hoffmann, A.O. and Birnbrich, C., 2012. The impact of fraud prevention on bank-customer relationships: An empirical investigation in retail banking. International journal of bank marketing, 30(5), pp.390-407.

- Jumaev, M. and Hanaysha, J.R., 2012. Impact of relationship marketing on customer loyalty in the banking sector. Far East Journal of Psychology and Business, 6(4), pp.36-55.

- Merton, R.C. and Thakor, R.T., 2018. Customers and investors: a framework for understanding the evolution of financial institutions. Journal of Financial Intermediation.

- Mullineux, A., 2012. UK Banking After Deregulation (RLE: Banking & Finance). Routledge.

- Mullineux, A., 2012. UK Banking After Deregulation (RLE: Banking & Finance). Routledge.

- Ngo, V.M. and Nguyen, H.H., 2016. The relationship between service quality, customer satisfaction and customer loyalty: An investigation in Vietnamese retail banking sector. Journal of Competitiveness.

- Saunders, A., Strock, E. and Travlos, N.G., 2014. Ownership structure, deregulation, and bank risk taking. the Journal of Finance, 45(2), pp.643-654.

- Sharpe, S.A., 2016. Asymmetric information, bank lending, and implicit contracts: A stylized model of customer relationships. The journal of finance, 45(4), pp.1069-1087.

- Tabak, B.M., Fazio, D.M. and Cajueiro, D.O., 2015. The relationship between banking market competition and risk-taking: Do size and capitalization matter?. Journal of Banking & Finance, 36(12), pp.3366-3381.

- Tansuhaj, P., Wong, J. and McCullough, J., 2014. Internal and external marketing: effects on consumer satisfaction in banks in Thailand. International Journal of Bank Marketing, 5(3), pp.73-83.